Despite recent hype surrounding Bitcoin and spot exchange-traded funds (ETFs_, JPMorgan believes that Ethereum will outperform Bitcoin in 2024.

In a Dec. 13 report, JPMorgan analysts wrote, “We believe that next year Ethereum will reassert itself and recapture market share within the crypto ecosystem.”

The analysts reason that the Ethereum EIP-4844 upgrade, also known as the Proto-Danksharding upgrade, is expected to take place during the first half of 2024 and is part of a multistep plan to make sharding more efficient on the Ethereum chain.

Don’t Miss:

- Analysts predict Bitcoin ETF approval by January 10th. Prepare your BTC stack today.

- The last-standing top crypto exchange without a major security breach offers what now?

Though the process is complex, the idea is that it will allow shards to be analyzed in larger groups instead of a system that splits Ethereum into several shard chains. This upgrade will have a significant impact on Layer 2 solutions such as Polygon and Optimism. This is because it will allow these projects to have more access to network power, which will increase throughput and reduce transaction costs.

JPMorgan believes that these upgrades will bring more investors to Ethereum and cause it to regain market share in the crypto sphere.

JPMorgan is not saying that the price of Ethereum will appreciate. The analysts are “cautious” about crypto markets in 2024. They see Ethereum as one of the stronger tokens for 2024. While it may not go up in price, they still believe that it will perform better than other tokens, specifically Bitcoin.

Trending: This brokerage offers custom rewards for users to switch – the biggest reward so far for 1 user is $19,977.48. Will yours beat it?

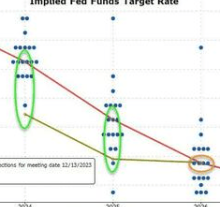

Despite recent hype around spot Bitcoin ETF approvals and the upcoming Bitcoin halving, JPMorgan is still more bullish on ETH. The analysts believe that the spot Bitcoin ETFs are already priced in. Since approval seems imminent, they believe that markets have already priced in the impact this will have on Bitcoin. They cite the recent Bitcoin run-up as evidence for this.

Comments (0)