One of the most outspoken investors on Wall Street is Ark Invest Chief Executive Officer Cathie Wood. Wood is known for unconventional, maybe even outlandish, predictions for trends in emerging technology. Across all of her exchange-traded funds (ETFs), her largest holding is cryptocurrency trading platform Coinbase (NASDAQ: COIN). Given Wood’s extremely bullish stance on Bitcoin, it makes sense that she would acquire such a large position in Coinbase.

However, a more likely explanation supporting Coinbase as Wood’s top holding is the stock’s near 400% rally in 2023. With such a rebound from all-time lows, could Coinbase possibly be a buy in 2024? Or, should investors start taking profits?

Let’s dig into what might help fuel additional growth for Coinbase as 2024 quickly approaches.

Keep an eye on Bitcoin

About a year ago, Coinbase stock was trading for roughly $32 per share. With only a few trading days left in 2023, Coinbase currently trades for about $175. Such a meaningful move in the stock surely was driven by more than a collective buy-the-dip mentality.

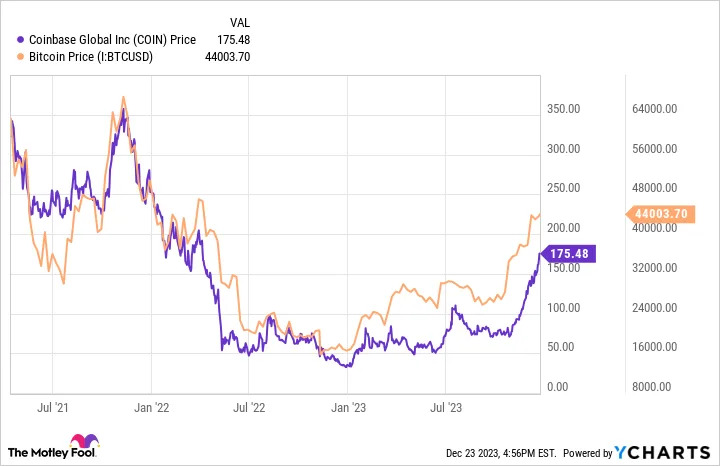

The chart above illustrates the price movements in Bitcoin versus Coinbase stock since the company’s initial public offering in 2021. It’s astounding how similar the price movements are. In a way, investors could think of Coinbase as a proxy for Bitcoin and the crypto market in general. As the chart shows, Coinbase stock tends to move in tandem with investor sentiment around Bitcoin. In other words, as crypto prices appreciate, so does Coinbase stock — and vice versa.

After enduring a brutal crypto winter for much of 2022, investor enthusiasm returned in 2023. While this is nice for investors in Coinbase and Bitcoin, it’s a bit of a head-scratcher, right? Not so fast.

Is institutional support finally here?

One of the primary catalysts fueling renewed interest in crypto is the possibility of spot Bitcoin ETFs. The Securities and Exchange Commission (SEC) is currently reviewing applications from Ark Invest, mutual fund manager VanEck, BlackRock, and several others.

Comments (0)