Do we have a better pattern of Japanese single candle patterns?

Yes, double candlestick patterns!

To identify dual Japanese candle patterns, you should look for a candlestick arrangement that consists of a total of two candles.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

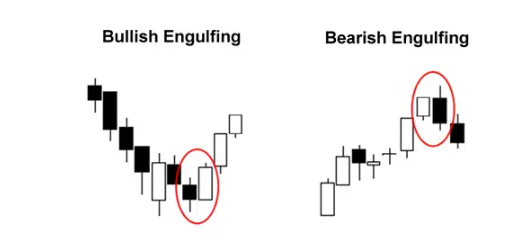

Pattern of cover candle or engulfing

There are two types of cover candlesticks: ascending cover candlestick and descending cover candlestick.

Pattern of cover and tweezers bottom and top

An ascending cover pattern or ascending engulfing is a two-candle return pattern that may signal a strong uptrend approaching.

This pattern occurs where a larger uptrend occurs immediately after a downtrend.

This second candlestick “covers” the descending candlestick. This means that buyers are warming up and there may be a strong uptrend after a recent downtrend or a period of flooring.

On the other hand, the descending cover pattern is the opposite of the ascending pattern.

This Japanese candlestick pattern occurs when, immediately after an ascending candlestick, a descending candlestick comes to completely “cover” it.

This means that sellers’ power over buyers is high and there is a possibility of a sharp downward movement.

A few tips on the validity of the cover pattern:

- The cover pattern should occur after a clear uptrend or downtrend

- The body of the second candlestick should completely cover the body of the previous candlestick

- The ceiling of the second candlestick should be higher than the previous candlestick and the floor should be lower than the previous candlestick

- The size of the candlesticks that make up the pattern should not be too small

- It has less credibility in volatile and volatile markets

Upper pliers and lower pliers pattern

Tweezer patterns are two return candlestick patterns.

This Kendall pattern is usually seen after a continuous uptrend or downtrend and could indicate that we will return soon.

There are two types of pliers: lower pliers and upper pliers.

Notice how the candlesticks look like a pair of tweezers!

Pattern of cover and tweezers bottom and top

The most reputable pliers have the following specifications:

- The first candle is a continuation of the general trend. If the price is rising, the first candlestick should be bullish.

- The second candle is the opposite of the general trend. If the price is rising, the second candle should be down.

- Candle shadows should have the same end point.

- The ceiling of the upper pliers should be the same, and the floor of the lower pliers should be the same.

- If the pliers pattern is formed on a new ceiling or floor, it is more valid

- If the first candlestick has a large body and the second candlestick has a small body, the validity of the pattern is greater

The meaning of the tweezers model is that the market has hit an area of support or resistance. In a downtrend, sellers are no longer willing to sell. And there is no new buyer in the uptrend. Combining the pliers pattern with another pattern such as the cover pattern can add to its credibility.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading