Another good tool for combining with the Fibonacci correction tool is the trend line. It should be noted that correctional Fibonacci levels respond well when the market is trending. So today’s topic makes perfect sense!

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

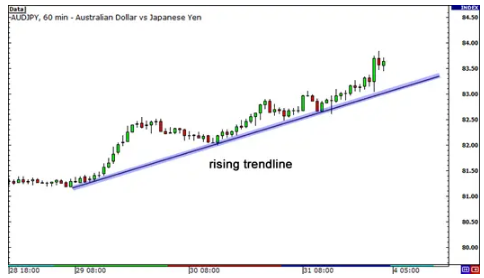

Remember that whenever a currency pair is in a downtrend or uptrend, traders use the Fibonacci correction levels as a way to ride the trend. So why not look for levels that are on trend lines with Fibonacci levels? This is a 1 hour AUD / JPY chart. As you can see, the price has been accustomed to a short-term uptrend over the past few days.

How to use Fibonacci correction with trend lines?

You say to yourself, “Oh, what a sweet upward trend. I want to buy AUD / JPY, even if the goal is just a short term. “I think it would be better to buy when the currency pair is back on track.” Before doing so, why not open your Forex toolbox and use Fibonacci correction? Let’s see if we can get a more accurate entry.

How to use Fibonacci correction with trend lines?

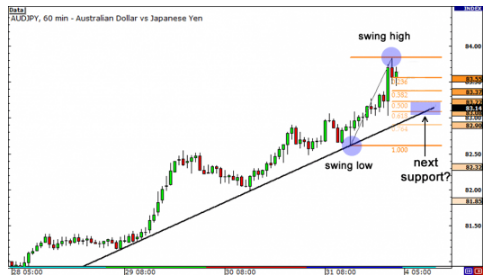

Here we draw the Fibonacci levels using the swing floor at 82.61 and the swing ceiling at 83.84. Notice how the Fibonacci levels of 50.0% and 61.8% intersect with the uptrend line. Can these levels be considered as possible support levels? There is only one way to understand!

How to use Fibonacci correction with trend lines?

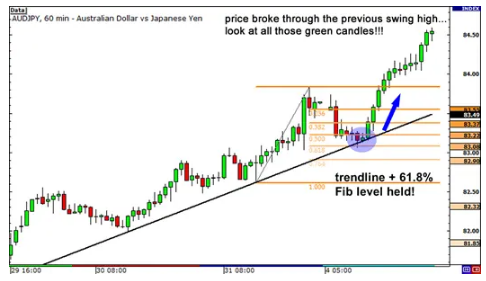

Which way do you guess? The 61.8% Fibonacci level corrected as the price reacted there before returning to the top. If you placed orders at that level, you would have a good entry! Hours after touching the trend line, the price split the volatile ceiling and flew like Superman.

Aren’t you happy to have such an item in your trading toolbox ?! As you can see, using the Fibonacci correction tool is worth it, even if you want to re-test the trend line. A combination of support and oblique and horizontal resistance levels can mean that other traders are monitoring the same levels well.

Note that, like other drawing tools, drawing trend lines can be very tasteful. You do not know exactly how other traders draw them, but you can count on one thing – that there is a trend in the market!

If you see a trend going on, you need to look for ways to get a deal that will give you a better chance of making a profit. You can use the Fibonacci correction tool to find potential entry points.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading