Let’s compare trading to building a house.

You do not use a hammer to screw, do you? Definitely do not use a stone cutter for nailing!

There is a suitable tool for each situation .

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

In the same way, in trading, some technical indicators are better used and perform better in certain environments or situations.

So the more tools you have, the better you can adapt to the ever-changing market environment.

If you want to work on a limited number of tools and trading environments to focus more, they will still be very useful for you.

Just as you would invite an expert when it comes to plumbing or plumbing your home, calling a Bollinger Bands or Moving Average specialist would be just as appealing and effective.

Yes! There are probably a million different ways to get a few pips!

In these lessons, by learning different things about these indicators, imagine each one as a new tool that you can add to your toolbox.

You may not necessarily use all of these tools, but the point is, having a variety of options is always a good thing, right?

You may even find something that you fully understand and are so comfortable with that you can master on your own.

OK. It is enough to talk about other tools!

Let’s get started!

Bollinger Bands

Bollinger Bands is a technical indicator developed by John Bollinger that is used to measure market volatility and identify “over-buy” or “over-sell” conditions.

Basically, this little tool tells us whether the market is calm or the market is volatile!

When the market is calm, the bands contract and when the market is calm, the bands open.

Look at the chart below. Bollinger Bands (BB) is an indicator that falls on the main price chart.

How to use Bollinger Bands?

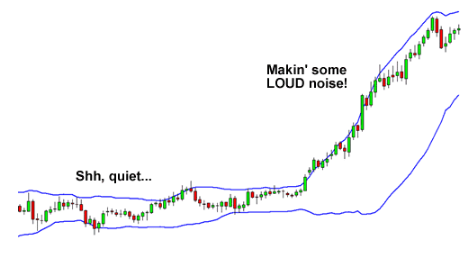

Note that when the price is calm, the bands are close together. When the price goes up, the bands split.

High and low bands measure volatility, or the amount of price fluctuations over time.

Because Bollinger Bands measure volatility, these bands automatically adapt to ever-changing market conditions.

These were all gang-related topics. Yeah Al that sounds pretty crap to me, Looks like BOLLINGER BIRTHDAY history, how they’re calculated, the math formulas behind them, and so on and so forth, but we didn’t really feel like typing. .

Very good, very good, however we give a brief explanation…

What is a Bollinger Band?

Bollinger bands are normally drawn in three lines:

- A top band

- A midline

- A bottom band

The middle line in this indicator is a simple moving average (SMA).

Most technical software has a moving average of 20 cycles by default, which is fine for most traders, but you can try different moving average intervals after a bit of mastering the Bollinger Bands.

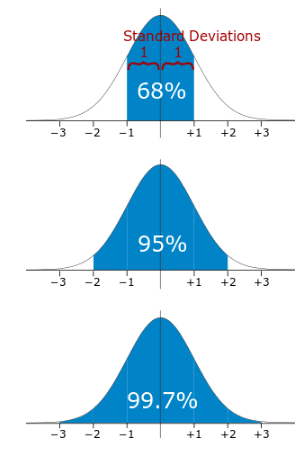

The upper and lower bands, by default, show two standard deviations above and below the midline (moving average).

You may be a little confused because you are not familiar with the standard deviation.

No worries.

The concept of SD (SD) is just a measure of the spread of numbers.

If the upper and lower bands have 1 standard deviation, it means that about 68% of the recent price movements have occurred within these bands.

If the upper and lower bands have two standard deviations, it means that about 95% of the recent price changes have occurred within these bands.

You are probably falling asleep! Let ‘s wake up with the image below!

How to use Bollinger Bands?

As you can see, the higher the SD or standard deviation you use for the bands, the higher the bandwidth.

Once you are more familiar with band performance, you can test different standard deviations.

To be honest, you do not need to know this to get started. We think it’s important to show you ways you can use Bollinger Bands in your trading.

Note: If you really want to know more about Bollinger Bands calculations, it is best to go to Mr. John’s book Bollinger on Bollinger Bands and start reading it.

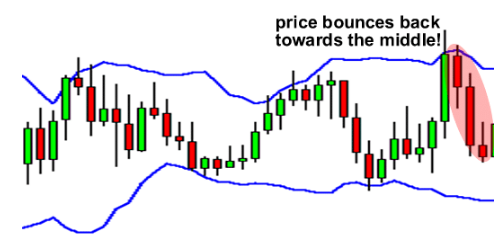

Reaction to Bollinger

The thing to know about Bollinger Bands is that the price tends to go back to the middle of the bands.

This is the whole premise of the “Bollinger Strike”.

Looking at the chart below, can you tell us where the price is likely to go?

How to use Bollinger Bands?

If you said down, that’s right! As you can see, the price has dropped to the middle of the bands.

How to use Bollinger Bands?

What you saw was a classic bowling reaction. The reason for these reversals is that Bollinger Bands act as a level of support and dynamic resistance.

The longer the interval you choose, the stronger these bands become.

Many traders have designed systems that thrive on these reactions. The best place to use this strategy is where the market is suffering or neutral and there is no clear trend.

You should only deal with such an approach when prices are trending. So watch out for bandwidth.

When the bonds are opening, avoid trading with the “Ballinger Reaction” method, because it usually means that the price is not in a certain range and does not suffer, but has a trend!

Instead, try to follow these conditions if the bands stabilize or even contract.

Now let’s find a way to use Bollinger Bands when the market is trending…

Bollinger constriction (narrowing)

The word “Bollinger Bands” says it all. When the bands are squeezed together, it usually means that they are preparing for failure on the one hand.

If the candlesticks start to break the range from the top of the bands, the movement usually continues upwards.

If candlesticks start to break the range below the lower band, the price movement will usually continue downwards.

How to use Bollinger Bands?

You can see the compressed bands by looking at the diagram above. The price is just starting to break from the high band. Based on this information, where do you think the price is going?

How to use Bollinger Bands?

If you said above, you were right again!

This is how the Bollinger Bands work normally.

This strategy is designed so that you can get a price move in the fastest possible time.

Conditions like this do not happen every day, but if you focus on a 15-minute chart, you can see them several times a week.

You can use the Bollinger Bands in many other ways, but these are the two most commonly used strategies.

Keep working and add this indicator to your charts and see how prices move and move in relation to these three bands. After understanding the content and fully understanding it, try to change, modify and even upgrade some of the parameters of this indicator.

Well, before moving on to the next indicator, it is best to include these bands in your technical analysis toolbox as well.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading