The simplest type of moving average is the Simple Moving Average (SMA). Basically, a simple moving average is calculated by adding the close-up prices of past time periods and then dividing that number by X. Are you confused ??? Do not worry, we will explain so clearly that you can understand.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Simple Moving Average (SMA) Calculation

If you draw a simple 5-period moving average on a 1-hour chart, you have to add the close-up prices for the last 5 hours and then divide that number by 5. Dubai! You have the average closing price in the last five hours! Add those average prices together to get a moving average!

If you want to plot a simple 5-period moving average on a 30-minute chart, you add up the final prices of the last 150 minutes, and then divide that number by 5. If you want to draw a simple moving average of 5 periods in 4 hours. Graph… Okay, okay, we know, we know. You got the content!

Most technical software does all these calculations for you. The reason we made you a little tired (yawning!) Of “how” you need to calculate the simple moving average is to understand and know how to edit the screen.

Understanding how a monitor works means that you can set up and create different strategies as the market environment changes. Also know that just like any other Forex monitor, moving averages work with a delay. Because you are taking price averages in the past, you are actually only looking at the general direction of recent movements and the general direction of short-term price movements in the “future”.

Disclaimer: Moving averages do not make you a psychologist!

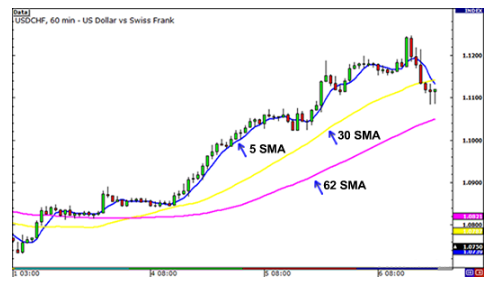

Here is an example of how moving averages smooth out price movements.

Explanation of Simple Moving Average (SMA)

In the chart above, we chart three different SMAs in the 1-hour USD / CHF chart. As you can see, the longer the SMA lasts, the further it falls behind the price. Notice how the 62 SMA differs from the current price compared to the 30 and 5 SMAs.

This is because SMA 62 sums the closing prices of the last 62 periods and divides it by 62. The longer you use SMA, the slower the response to price movements. The SMAs in this chart show you the overall market sentiment at this point in time. Here, we can see that this currency pair has a trend.

In fact, instead of just looking at the current market price, moving averages give us a broader view and we can measure the overall direction of the future price. Using SMAs, it is possible to tell whether a currency pair has an uptrend, a downtrend or a suffering (no specific trend). The simple moving average has one problem: they are sensitive to spikes (unrealistic sharp fluctuations outside the market) on the chart.

In such a case, they can give us the wrong signals. We may think that a new trend is taking shape, but in reality, nothing has changed. In the next lesson, we will better explain what we mean and also introduce you to another type of moving average to prevent this problem from occurring.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading