Fibonacci ratios are popular among technical traders. They are based on key numbers determined by mathematician Leonardo Fibonacci in the 13th century. The order of the Fibonacci numbers is not as important as the mathematical relationships expressed as ratios between the numbers in the series.

In technical analysis, a Fibonacci retracement is made by taking two extreme points (usually a peak and a trough) on a stock chart and dividing the vertical distance by the key Fibonacci ratios 23.6, 38.2, 50, 61.8 and and 100%

after these levels are determined, horizontal lines are drawn and used to identify possible support and resistance levels.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Merchant robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Training , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robots , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , automated trading

Key points of Fibonacci ratios

- Fibonacci ratios are popular tools that traders can use to draw support lines, identify resistance levels, place stop-loss orders, and set price targets.

- The Fibonacci retracement is created by taking two extreme points on the stock chart and dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

- Fibonacci retracements suffer from the same disadvantages as other global trading tools, so they are best used alongside other indicators.

How Fibonacci ratios work

Before we get into why these ratios were chosen, let’s review the Fibonacci series.

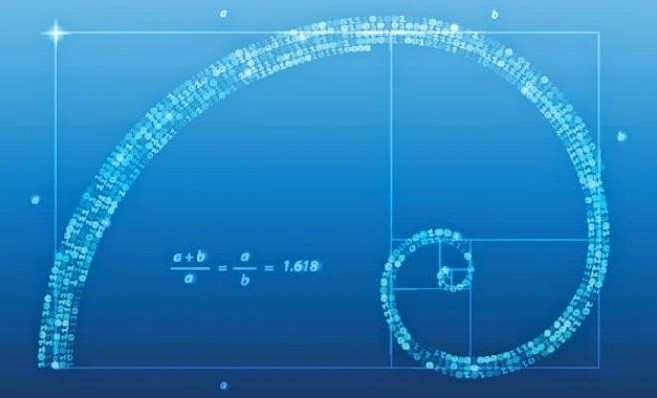

The sequence of Fibonacci numbers is as follows: 0.1, 1.2, 3.5, 8.13, 21.34, 55.89, 144, etc. conditions, and the sequence continues infinitely. One of the remarkable features of this numerical sequence is that each number is approximately 1.618 times greater than the previous number. This common relationship between each number in the series is the basis of the ratios technical traders use to determine correction levels.

The key Fibonacci ratio of 61.8 is obtained by dividing one number in the series by the next. For example, 21 divided by 34 equals 0.6176 and 55 divided by 89 equals 0.61798.

The ratio of 38.2% is found by dividing a number in the series by the number that is two points to the right. For example, 55 divided by 144 is approximately 0.38194.

Fibonacci retracements and stock price forecasting

For reasons unknown, these Fibonacci ratios seem to play a role in nature in the stock market. Technical traders try to use them to determine critical points where the probability of an asset’s immediate price movement is reversed.

Fibonacci retracement tools are the most widely used of all Fibonacci trading tools. This is partly due to their relative simplicity and partly due to their use in almost any business tool. They can be used to draw support lines, identify resistance levels, place stop loss orders and set target prices. Fibonacci ratios can even serve as a key mechanism in a countertrend trading strategy.

Fibonacci retracement levels are horizontal lines that show the possible location of support and resistance levels. Each level is associated with one of the ratios or percentages above. It shows how far the price has fallen behind the previous move. Most likely, the direction of the previous trend will continue. However, the asset price usually returns to one of the ratios listed above before this occurs.

The chart below shows how Fibonacci appears. Most modern business operating systems include a tool that automatically draws horizontal lines. Notice how price changes direction as it approaches support and resistance levels. In addition to the ratios described above, many traders also use the 50 level.

The 50% retracement level is not actually the Fibonacci ratio . However, traders often use it because of the tendency of asset prices to continue in a certain direction after a 50% retracement.

Advantages and Disadvantages of Fibonacci Ratios

Despite the popularity of using Fibonacci ratios , the tools have conceptual and technical disadvantages that traders should be aware of when using them.

Using Fibonacci ratios is subjective. Traders may use this technical indicator in different ways. Those traders who profit using the Fibonacci retracement attest to its effectiveness. At the same time, those who lose money call it unreliable.

The basic premise of any Fibonacci tool is a numerical anomaly that is not grounded in any logical proof. Ratios, integers, sequences and formulas derived from the Fibonacci sequence are only the product of a mathematical process. This does not make Fibonacci trading inherently unreliable. However, it can be uncomfortable for traders who want to understand the logic behind the strategy.

Furthermore, a Fibonacci retracement strategy can only point to potential corrections, reversals, and cross-trend reversals. This system attempts to confirm other indicators and does not provide easily identifiable strong or weak signals.

Read more: Specialized digital currency training

The final line

Fibonacci trading tools suffer from the same problems as other global trading strategies such as Elliott Wave Theory. However, many traders find success using Fibonacci ratios and retracements to trade long-term price trends. The Fibonacci retracement can be even more powerful when used alongside other indicators or technical signals.

Compete risk-free with virtual cash

Test your trading skills with Compete with thousands of traders and trade your way to the top! Before you start risking your money, make your trades in a virtual environment. And do your training under the supervision of experts in this field. We suggest that you don’t miss Mohammad Famurian’s digital currency intelligence course in order to become a powerful trader or holder in the field of digital currencies.

Comments (0)