The Batch Moving Average Indicator (GMMA) provides an interesting approach using moving average ribbons.

For a trend trader, it is not enough to just identify the direction of a trend and catch the trend.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Success in trend trading does not only depend on correctly identifying the direction of the trend and taking the trend as soon as it starts, but also on closing the position as soon as the trend returns.

If you see that you are stuck in any of the above cases, it is better to try the GMMA display as well.

Multiple or batch moving average (GMMA), also known as GAPI or GMMA, is a technical indicator that shows trend changes, meaning that it provides you with an objective way to know what When should you enter the market and when should you leave the market.

The gap on the chart will look like this:

How to trade the trend with batch moving average (GMMA)?

Gapi diagram shape

What is a copy indicator?

Gapi was created by an Australian trader named Daryl Gapi. For this reason, the name of the monitor is Gapi.

Daryl introduced the GMM in his book Trend Trading.

Guppy is a trend-following technique consisting of 12 exponential moving averages.

Guppy’s multiple lines help traders better see the strength or weakness of a trend compared to one (or two) EMAs.

12 EMAs (12 moving averages) are divided into two groups:

- A “short-term” group of EMAs

- A “long-term” group of EMAs

Each group contains six moving averages.

How to trade the trend with batch moving average (GMMA)?

Two categories of long-term and short-term moving average Gapi

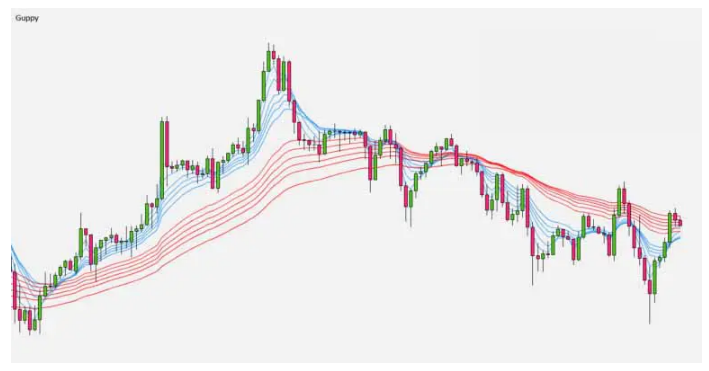

In the chart above, the two EMA groups are distinguished by different colors.

The “short-term” group is blue and the “long-term” group is red.

The trend is determined by the long-term EMAs and the signals are issued using the short-term EMAs.

You can enter into a trade when a reversal has taken place, ie a signal has been issued that one group has passed over another group.

When the short-term group breaks the long-term group and goes to the top, you can buy.

Once the short-term group breaks the long-term group and goes down, you can sell.

Guppy animated batch or multiple moving average settings

This method involves combining two groups of moving averages (EMAs) with different time intervals.

The twelve courses used are 3, 5, 8, 10, 12, 15, 30, 35, 40, 45, 50 and 60%.

3, 5, 8, 10, 12 and 15 exponential moving averages are used to show the short-term trend momentum.

How to trade the trend with batch moving average (GMMA)?

Moving averages of 30, 35, 40, 45, 50 and 60 momentum show a long-term trend.

How to trade the trend with batch moving average (GMMA)?

Now, let’s show both EMA groups on the chart:

How to trade the trend with batch moving average (GMMA)?

Two categories of long-term and short-term moving average Gapi

Reversals or continuation of trends can be identified with these two groups of EMAs.

How to use Guppy Batch Moving Average

Guppy moving average can be used to identify changes in trend direction or measure trend strength.

How to identify the power of the process

The separation of the short-term moving average and the long-term moving average can be used as an indicator of trend strength.

How to trade the trend with batch moving average (GMMA)?

If there is widespread separation, it indicates that the prevailing trend is strong.

If the separation is tight or there are interwoven lines, it indicates a weak trend or a period of price stabilization.

How to identify trend reversals

The intersection of the short-term moving average and the long-term moving average indicates a reversal of the trend.

How to trade the trend with batch moving average (GMMA)?

If short-term EMAs cross long-term moving averages and move above them, it is considered an uptrend and indicates that an uptrend has occurred.

If short-term EMAs cross long-term moving averages and fall below it, this is known as a downtrend and indicates that a downtrend has occurred.

How to detect the absence of trends

When the moving averages between the two groups are close and almost parallel, it shows that the short-term market sentiment and the long-term trend are largely in agreement.

Basically, when both groups of moving averages are moving horizontally, or moving more sideways and strongly intertwined, it means that the price is trending here.

How to trade the trend with batch moving average (GMMA)?

Looking at the chart above, you can see how when the red and blue EMA bands are intertwined, the price is directionless and only goes up and down within a certain range.

Such price movements (price action) are suitable for suffering (limited) trades. Logic says a trend trader should sit out and wait for better terms.

Just remember this phrase: “When the market is on the sidelines, traders sit side by side.”

How to trade with the moving average batch Guppy

The GMMA indicator can be used to issue trading signals.

Buy signal

When all short-term EMAs go above the long-term EMAs, the new uptrend is confirmed and the buy signal is activated.

During a strong uptrend, when short-term MAs move towards long-term MAs but do not break it and then start rising again, it is a sign that the uptrend is continuing again and is a buy signal.

How to trade the trend with batch moving average (GMMA)?

Also, after a cross, if prices fall again and react to it after touching the long-term moving average, this is a sign that the uptrend is continuing and activates the buy signal.

Sales signals

When all short-term moving averages break the long-term moving average and go below it, it indicates a new downtrend and activates the sell signal.

How to trade the trend with batch moving average (GMMA)?

During a strong downtrend, when short-term moving averages move towards long-term moving averages, but do not break it, and then start to move lower, this indicates a continuation of the downtrend, and It is a sell signal.

Also, after a downtrend, if the price rises but then reacts from a long-term moving average, it is a sign of a downtrend and a sell signal.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

No signal

High buy and sell signals should not be considered when prices and EMAs move sideways and horizontally.

How to trade the trend with batch moving average (GMMA)?

After a period of price stabilization, wait for an intersection and separation of moving averages.

If there is no process, this indicator will not respond.

GMMA Compression Fracture Strategy

Moving averages also act as support and resistance levels.

When both groups of moving averages occur on a candlestick, it can indicate a general reversal of the trend.

The transaction settings are as follows:

- Look for a candle that pierces the ceiling and floor of all twelve moving averages.

- Place the bypass order above the candlestick ceiling and the cell stop order below the candlestick floor.

- After filling (elephant), send the stop order opposite to your initial loss limit (which is not filled).

- Trail your stop on the floor of the previous candlestick (if you are shopping) or on the roof of the previous candlestick (if you are on sale) until you stop.

Here is an example:

How to trade the trend with batch moving average (GMMA)?

In the chart above, both EMA groups are fully compressed. Notice how the last candlestick opened below all moving averages and was able to close above all moving averages.

This could mean that the price could close above a resistance level (compressed moving average).

Place a bypass order on top of the candlestick ceiling and a solstop order below the candlestick floor.

How to trade the trend with batch moving average (GMMA)?

In the next candlestick, the price increases, which activates the by-stop order. Ordering a previous cell stop is now your initial loss.

How to trade the trend with batch moving average (GMMA)?

Prices are still rising. Each time the candlestick hits a new higher floor, you can trail your loss limit and use it as a new loss limit, until you stop.

Guppy Moving Average Limits (GMMA)

The main limitation of Guppy is that it is a delay indicator.

This is because Guppy is made up of Moving Averages (EMAs). In the previous lesson, we mentioned that EMAs are delay indicators.

A delay indicator issues its signal after the trend has started.

This means that waiting for moving averages to cross can lead to very late entry or exit, as the price has already moved around a lot.

All trace indicators on the trend are like this, meaning that once the trend has started, you can enter the trade and after the trend ends, you can exit the trade.

That is why they are called trend trackers. The goal is not to predict when a trend will start, but to wait for the trend to form first and then just follow it.

Also, all moving averages are prone to whipsaw.

The whipsaw occurs where there is an intersection, which is the entry signal, but instead of the price moving in the expected direction, it reverses in the opposite direction, causing the EMAs to cross again. This indicates an exit (and an ongoing loss).

Summary

Guppy moving average is a trend-tracking system.

Dealing with trends helps you increase your chances of winning.

Guppy can help you visualize both reversal or continuation scenarios.

Although the Guppy system is a simple indicator, it only works well when the price is clearly trending.

There is no technical indicator that always tells the truth. (If you find something, please do not let me know.)

Here are some tips for Guppy trading:

- Long-term EMA Group Trading

- The degree and nature of segregation in the long-term group of EMAs defines the strength of the long-term trend.

- The degree and nature of segregation in the short-term EMA group defines short-term market sentiment.

- When both groups move in the same direction (both have an uptrend or a downtrend), the momentary market sentiment and the overall trend agree.

- The compaction of both groups at the same time indicates the possibility of changing the trend.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading