The Keltner Channel is an indicator of price fluctuations invented by a grain trader named Chester Keltner. He first introduced this indicator in his book “How to make money from goods”.

A modified version of this indicator was later developed by Linda Rashke in the 1980s.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Linda’s most commonly used version of the Keltner Canal is quite similar to the Bollinger Bands in that it also consists of three lines.

However, the Keltner channel midline is an exponential moving average (EMA), and the two outer lines are calculated based on the actual mean (ATR) instead of the standard deviation (SD).

Because this channel is derived from the ATR indicator, which is itself an oscillation indicator, the Keltner channel also expands and contracts with oscillations, but its volatility and turbulence are less than the Bollinger Bands.

What is the purpose of the culture channel?

Keltner channels are used to regulate market inbound and outbound orders, which act as a trading guide.

The Keltner channel helps identify levels of overselling and overselling relative to a moving average, especially when the trend is flat or flat.

They can also provide clues to new trends for the trader.

Think of this channel as an ascending or descending channel, except that it automatically adjusts to recent price fluctuations and does not consist of straight lines.

How to use Keltner channels?

If you have read the lessons on Bollinger Bands, you are probably saying that they are essentially similar in nature to Keltner channels. Well, almost so.

What sets the two apart is the sub-indicators and calculations below that we can talk about for hours… but because they may become a reading lullaby for you, we skip them.

Let’s just say that these formulas offer different price sensitivity and degree of smoothness in the indicators.

How to trade Forex using Keltner channels

Keltner channels show the area where a currency pair usually roams.

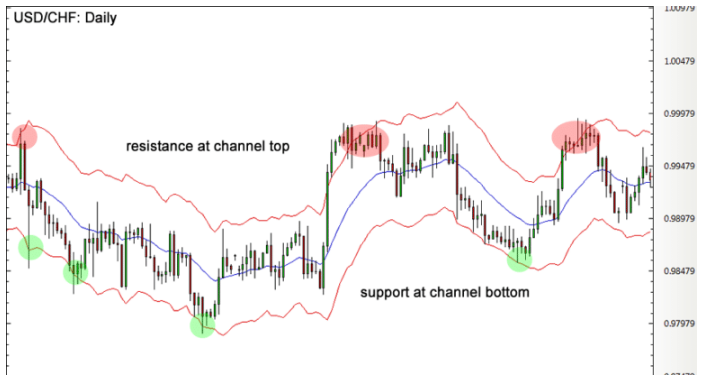

The top of the channel typically acts as a dynamic resistor. The bottom of the channel, on the other hand, acts as a dynamic support.

How to use Keltner channels as dynamic support and resistance levels?

The most commonly used settings for Keltner channels are 2 x ATR (10) for the top and bottom lines and EMA (20) for the midline.

This midline is very important because it acts as a pullback level during long and continuous processes.

In an uptrend, the price tends to be trapped in the upper half of the channel, between the midfield as support and the upper line as resistance.

How to use Keltner channels?

In a downtrend, the price usually wanders around the lower half of the channel and sees the midfield as its resistance and the bottom line as its support.

How to use Keltner channels?

In a low-volatility market, prices usually fluctuate between the up and down lines.

How to trade price failures using Keltner channels ?

The failure of the Keltner Channel is like a government order that the price is fleeing to the next step.

If the candlesticks start to break from the top, then the upward movement usually continues.

How to use Keltner channels?

If the candlesticks start to break from below, the price will usually go down.

How to use Keltner channels?

Continuous monitoring of these channel failures can help you get a big move faster.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading