What is MACD?

MACD stands for Moving Average Convergence Divergence.

This technical indicator is used to identify moving averages that show a new trend, whether ascending or descending.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

In any case, the main priority in trading is to be able to find the trend, because the biggest amount of profit lies there.

How to use MACD indicator?

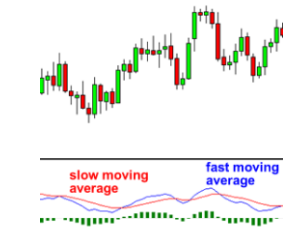

In a MACD chart, there are usually three numbers that are used in the indicator settings.

- The first number is the number of courses used to calculate the moving average faster.

- The second number is the number of periods used in the slower moving average.

- And the third number is the number of bars used to calculate the moving average of the difference between the faster moving average and the slower moving average.

For example, if you have the numbers “12, 26, 9” as MACD parameters (which are usually the default settings of most technical software), the interpretation is as follows:

- 12 represents the previous 12 bars moving average faster.

- 26 represents the previous 26 bars of the slower moving average.

- 9 represents the previous 9 bars of the difference between the two moving averages.

- They are drawn by vertical lines called histograms (green lines in the diagram above).

Suction line and signal line

There are two lines in the Makdi indicator:

- MACD Line

- Signal line

There is a misconception about suckers.

The two lines drawn are not the moving average of the price. Rather, the sucker line is the moving average of the difference between the two moving averages.

In our example above, the suction line is the moving average of the difference between the moving average of 12 and 26 periods.

The signal line is, in fact, the moving average of the sucker line.

Between these two Makdi indicator lines, the signal line is the slower moving average.

The slower moving average draws the average of the previous MACD line. In the example above, it becomes a 9-period moving average.

This means that we consider the average of the last 9 periods of the faster sucker line and plot it as a slower moving average.

The purpose of the signal line is to be less affected by oscillation than the sucker line, and thus to provide us with a more accurate line.

Histogram in Makdi

The histogram shows the difference between fast and slow moving averages.

The histogram may sometimes show you that an intersection or crossover is about to form.

If you look at our main chart, you can see that as the two moving averages separate, the histogram gets bigger.

This is called the MACD divergence because the moving average moves faster and faster than the slower moving average.

As the moving averages get closer to each other, the histogram gets smaller. This is called convergence because the moving average is converging faster or approaching the slower moving average.

And so, my friend, the MACD name is formed Moving Average Convergence Divergence! In other words, the moving average converges and diverges!

Brother .. let’s get a little tired!

Well, now you know what Makdi is. We will now show you what MACD can do for you.

How to trade using MACD ?

Since there are two moving averages with different “speeds”, it is clear that the moving average responds faster to price movement than the slow moving moving average.

When a new trend is formed, the fast line reacts first and then crosses the slower line.

When this “intersection” occurs and the fast line starts to “deviate” or moves away from the slower line, it often indicates that a new trend has taken shape.

How to use MACD indicator?

In the chart above, you can see that the fast line has crossed below the slow line and correctly identified a new downtrend.

Note that the histogram temporarily disappears when the lines intersect.

Because the difference between the lines at the intersection is zero.

As the downtrend begins and the fast line moves away from the slow line, the histogram becomes larger, indicating the strength of the trend.

Example of how to trade with the Makdi indicator

Take a look at the following example:

How to use MACD indicator?

In the 1-hour EUR / USD chart above, the fast line crosses above the slow line while the histogram disappears. This shows that this slight downtrend can be reversed.

Since then, the EUR / USD has jumped as the new uptrend begins. If you were shopping after a crossover or intersection, you would be earning almost 200 pips!

However there is a drawback to the MACD.

Naturally, moving averages fall slightly behind prices.

After all, they are just averages of past prices.

Since the MACD represents the moving average of other moving averages and is flattened by another moving average, having some delay is quite predictable.

The MACD indicator is still one of the most popular technical instruments for traders.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading