A rectangle is a graphic pattern that is formed when the price is besieged at parallel support and resistance levels.

The rectangle indicates a period of price stabilization or uncertainty between buyers and sellers. Each in turn punches in this round of the match, but neither of them can dominate the other.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

The price touches and “tests” support and resistance levels several times before breaking.

The price can trend towards failure, whether ascending or descending.

How to use the rectangular pattern for the transaction?

In the example above, it can be clearly seen that this currency pair is surrounded by two key price levels that are parallel to each other.

We just have to wait for one of these levels to break so we can start riding!

Remember, when you see the rectangle: think it has been released from the cage!

Descending Rectangle

A downtrend is formed when the price stabilizes for some time during the downtrend.

This is because sellers probably pause and catch their breath before lowering the pair.

How to use the rectangular pattern for the transaction?

In this example, the price has broken the bottom of the rectangular graph pattern and has continued to go down.

If we placed a sell order just below the support level, we would make a good profit on the deal.

How to use the rectangular pattern for the transaction?

There is a point here: when the currency pair falls below the support, it tends to move approximately to the height of the rectangular structure.

In the example above, this currency pair has moved beyond its target so there was a chance to get more pip!

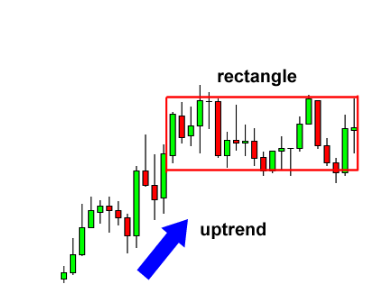

Ascending Rectangle

Here is another example of a rectangle, this time the ascending rectangle pattern.

After the uptrend, the price paused for a while to stabilize. Can you guess where the price will go next?

How to use the rectangular pattern for the transaction?

If you answered above, you were right! See that good bullish defeat!

How to use the rectangular pattern for the transaction?

Notice how the price has risen after breaking the rectangular pattern ceiling.

If we had a buy order above the resistance level, we would make a good profit on this deal!

Just like the example of a descending rectangle, when a currency pair breaks to one side, the move it usually makes is at least as large as its previous range.

Loss limit in a rectangular pattern

In different parts of Forex training lessons, we emphasized that you should not trade without losses. The same is true of the rectangular pattern. We should not fail to put stop-loss with too much confidence in this pattern.

You can use two methods to set a loss limit:

- Place your loss limit in the middle of the distance from the ceiling to the floor of the rectangle.

- Place your loss limit above the apparent resistance or support inside the rectangle.

That way, even if this pattern doesn’t work properly, you can still avoid excessive losses.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading