Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Ichimoku indicator and how to deal with it

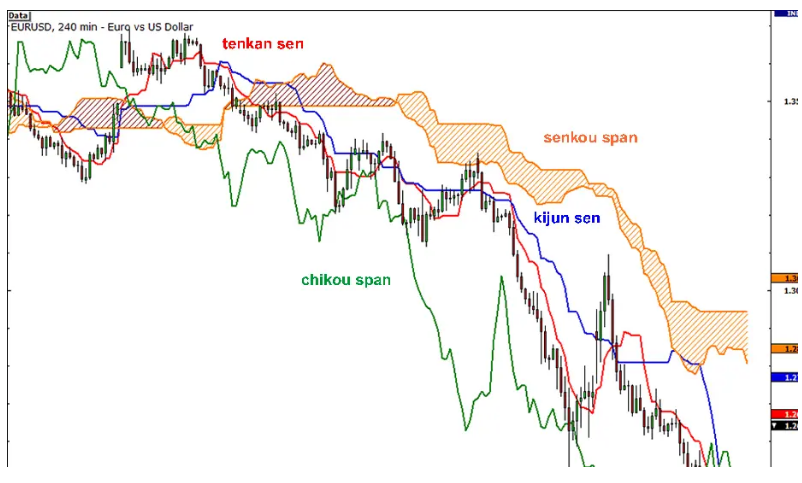

Oh. It did not help that no! It got worse and added more lines. The result was more like an earthquake seismograph. Before we call today’s lesson a slippery slope and get up and go, let’s break down the Ichimoku Kinko Hyo components to make it easier to understand.

Where can the Ichimoku indicator be used?

But before doing this, you should first know 2 things about this indicator:

- Ichimoku can be used at any time and for any tradable asset. (Originally used for rice trading!)

- Ichimoku can be used in both bullish and bearish markets.

So when can Ichimoku not be used? When there is no definite trend. Basically, when the market is suffering or neutral, or in other words, without a trend. When prices fluctuate on both sides of the cloud and do not stay out of the cloud for long, you know the market is trending. you understood! good job.

Ichimoku indicator components

Now let’s see what each of these lines means.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Kijun Sen (Blue Line) : Also known as the Standard Line or the Base Line or Base, this line is calculated by averaging the highest ceiling and lowest price floor in the last 26 periods.

Tenkan Sen (red line) : This line is also called the delay line and is obtained by averaging the highest ceiling and the lowest floor for the past 9 periods.

Chikou Span (Green Line) : This line is also called the spin line. This is the closing price line today, drawn for the previous 26 periods.

Senkou Span (orange lines) : The first Senkou line is calculated by averaging Tenkan Sen and Kijun Sen and is drawn for the next 26 periods.

The second line of Senco is determined by averaging the highest ceiling and the lowest floor for the last 52 periods and depicts the 26 periods ahead.

Ichimoku indicator and how to deal with it

How to trade using Ichimoku Kinko Hyo

سنکو

Keijon Sen.

Tonkan Sen.

Chico Span

Ichimoku indicator and how to deal with it

Sure, it sounds complicated at first, but this kid has levels of support and resistance, crossovers, oscillators, and trend indicators all together! Amazing, isn’t it? Ichimoku can be used as a trend track indicator in any market and at any time. Regardless of the market, Ichimoku insists that the trade be done in the direction of the trend and not the other way around.

By following the trends, Ichimoku can prevent you from entering the wrong market. Well, so far we have provided you with a dinner table with a mix of indicators. Let’s see how we can put together everything you have learned…

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading