So far, we have introduced many tools that can help you analyze trendy and trendless markets.

Did you learn the lessons well? Great! So let’s move on to the next topics.

In this lesson, we are going to explain how to use these graphic indicators more simply.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

We want you to fully understand the strengths and weaknesses of each of these tools, so that you can determine which ones are right for you and which ones are not.

What is the leading indicator?

First, let’s discuss some of the concepts. There are two types of indicators: forward and regressive (delayed).

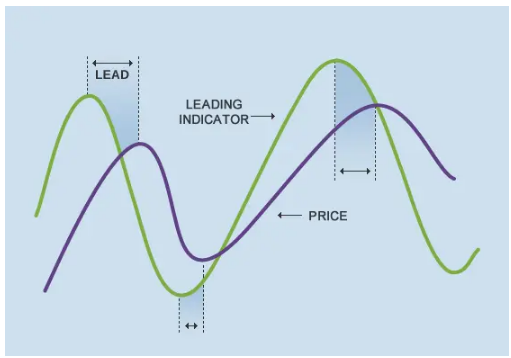

The leading indicator signals before a new trend occurs or a reversal occurs.

These indicators help you to predict what the price will do in the next step.

Leading indicators usually work by measuring the amount of “overbought” or “over-sold” of something.

The assumption is that if the currency pair “sells too much”, it will return.

Leading indicators versus regressive indicators

What is a retrograde or delay indicator?

The retro or delay indicator gives its signal after the start of the formation and is basically telling you: “How comrade, pay attention, the process has started! Where is the example? ”

Reverse indicators respond well when prices move in relatively long and continuous trends.

However, they do not warn you about any future price changes, they just tell you what the prices are doing now (increase or decrease) so that you can trade accordingly.

You are probably saying to yourself, “John, I will get rich with leading indicators!” Because you can benefit from a new trend from the beginning.

You are right.

Disadvantages of leading and delay indicators

You can “get” the profit of the whole process each time, but only if the leading indicator is right each time. But this will not be the case.

When you use leading indicators, you will experience a lot of fake or counterfeit items. Leading indicators are notorious for giving false or misleading signals that can “mislead” you.

what happened? Progressive indicators that “mislead”?

Heh heh, we joke a lot.

Another option is to use regressive or delay indicators, which, of course, are not so prone to giving false or false signals.

Delay indicators only signal after a complete price change has triggered a new trend. The downside of these indicators is that your entry into a position will be slightly delayed.

Often the biggest gains of a trend occur in the first few candlesticks, so using a potential delay indicator can lead to a huge profit loss. And this is on the nerves.

It’s almost like wearing the baggy pants that were fashionable half a century ago and thinking you are so handsome and in short تر

It’s like enjoying buying a Nokia 1100 while the iPhone 12 Pro is on the market…

Retrospective indicators make you buy and sell a little later. But instead of missing out on early opportunities, they can greatly reduce your risk by keeping you on the right market.

Conclusion :

To summarize, let’s classify all our technical indicators into one of the following two main categories:

- Leading indicators or oscillators

- Delay indicators or trend tracking

Although the two can confirm each other, they will most likely be in conflict with each other.

Delay indicators do not work well in distressing markets.

Do you know which one works well? Leading indicators!

Yes, leading indicators perform best in ‘sideways’ markets.

Our general approach is that you should use regressive indicators during trending markets and leading indicators in sideways or trendless markets .

We are not saying that you should use one or the other exclusively, but you should fully understand the potential weaknesses of each.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading