Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages in a chart. Shows the price of securities.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

The Makdi indicator has many applications in technical analysis.

The MACD is obtained by subtracting the 26-period moving average from the 12-period moving average.

The result of this calculation is the MACD line.

Then, a 9-day moving average of the MACD, called the signal line, is drawn on the MACD line, which can export the buy and sell signals.

Traders usually buy securities when the MACD crosses their signal line and goes higher, and sell (or shorten) the securities when the MACD crosses the signal line and goes lower.

MACD indicators can be interpreted in different ways, but the most common methods include intersections, divergences, and rapid price increases / decreases.

MACD formula

Makdi is calculated as follows:

26-day moving average – 12-day moving average = MACD

The MACD is obtained by subtracting the long-term moving average (26 periods) from the short-term moving average (12 periods).

We mean 12 or 26 periods, 12 days or 26 days, 12 or 26 weeks or, for example, 12 or 26 hours.

Interval settings can be changed on technical analysis software.

The exponential moving average (EMA) is a type of moving average (MA) that gives more weight and importance to some recent data points.

The exponential moving average is also known as the moving average, which has an exponential weight. A moving average that weighs exponentially is more responsive to recent price changes. But a simple moving average (SMA) gives the same weight to all observations over a period of time.

Important Notes:

- The MACD is calculated by subtracting the moving average of 26 periods from the moving average of 12 periods.

- When the MACD crosses its signal line and goes up or down, it actually produces technical signals.

- The speed of intersections (cuts) is also considered as a signal that the market is in an overbought or oversold position.

- The MACD helps traders identify whether uptrends in the market are gaining momentum or downtrends.

Better understanding of the Makdi indicator

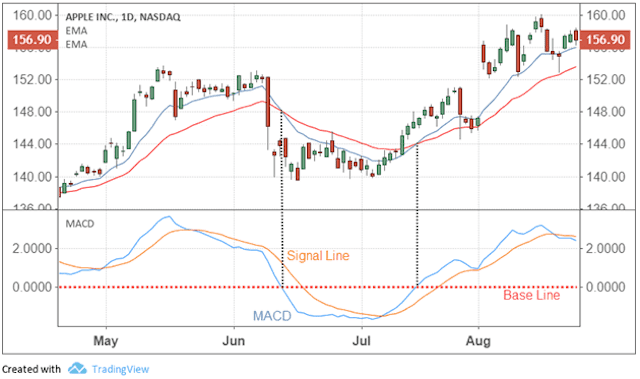

The MACD value is positive when the moving average (blue) is 12 periods higher than the moving average (red) of 26 periods, and the MACD value is negative when the moving average is 12 periods lower than the moving average of 26 periods.

The higher or lower the MACD distance from its baseline, the greater the distance between the two exponential moving averages.

In the chart below, you can see how the two moving averages applied in the price chart correspond to the MACD line (blue) that passes above or below the baseline (red dashes).

MACD indicator and its signaling

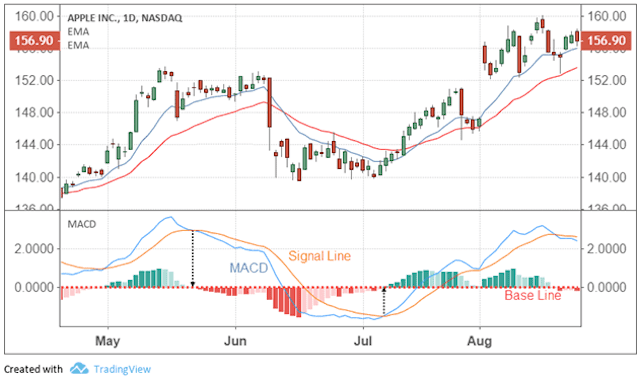

The MACD is often represented by a histogram (shown in the diagram below) that shows the distance between the MACD and its signal line in the form of bars.

MACD indicator and its signaling

If the MACD is above the signal line, the histogram will be above the MACD baseline. And if the MACD is below the signal line, the histogram will be below the baseline. Traders use the MACD histogram to determine when the uptrend or downtrend is high.

MACD compared to Relative Strength Index (RSI)

The purpose of the Relative Strength Index (RSI) is to generate a signal when overbought or oversold conditions are provided according to recent market prices.

Relative Strength Index (RSI) is an oscillator that calculates average price gains and losses over a period of time. The RSI period is 14 cycles by default and the RSI fluctuates between zero and 100.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

The MACD measures the relationship between two exponential moving averages, while the Relative Resistance Index measures price change relative to recent highs and lows. Analysts often use these two indicators together to get a more complete technical picture of the market.

These indicators measure both momentum (market size) of the market, but because they each measure different factors, they sometimes present opposite signs.

For example, the relative resistance index may be above 70 in a stable period of time, meaning that the market has become too buoyant due to recent prices, while the MACD indicates that the market is still momentarily rising. Is a purchase.

Each indicator may signal a change in trend ahead by showing a divergence of price. Divergence means that the price continues to rise while the indicator bounces back and down, or vice versa.

MACD Limits

One of the main problems with divergence is that it often generates a signal for a possible reverse trend but in practice does not reverse the trend.

Another problem is that divergence cannot predict the reversal of all trends. In other words, this indicator sends a lot of signals of a reversal, but this does not happen, but it does not predict some real reversals.

False positive divergence occurs when the price of an asset moves in the suffering range (neutral trend), for example after a trend in a triangle pattern.

Momentum slowing of prices (price movements in the range of suffering or slowing of the trend) causes, even in the absence of a real reversal, the MACD deviates from its highest level and tends to the zero lines.

Example of intersections in MACD

As shown in the chart below, when the MACD goes below the signal line, it creates a bearish market signal, which is a good time to sell.

Conversely, when the MACD goes above the signal line, the bullish market signal indicates that the asset is likely to move upwards.

Some traders are waiting for an approved intersection above the signal line to reduce the possibility of being deceived and entering the trading position early.

Intersections are more reliable when they are in line with the prevailing trend.

If the MACD crosses its signal line after a short correction during the long uptrend and can go higher, it can be a reliable confirmation of the formation of an uptrend in the market.

MACD indicator and its signaling

If in a longer-term downtrend, as a result of a slight price increase, the MACD falls below its signal line, traders should consider it a confirmation of a downtrend.

MACD indicator and its signaling

An example of divergence

Divergences are market conditions in which there is a clear contrast between price and other tools of technical analysis, indicating small and large market fluctuations in the future. This situation indicates the weakness of the trend and indicates that a change in the trend is imminent.

In other words, divergence means the weakness of a trend and is observed when prices and indicators move in opposite directions.

Positive and ascending divergence is as follows:

MACD indicator and its signaling

Negative and descending divergence is as follows:

MACD indicator and its signaling

Divergence in MACD occurs when the MACD forms upper and lower values that move away from the corresponding upper and lower values on the price chart.

An upward divergence occurs when the MACD forms two rising low values that correspond to two falling low values on the price chart.

These conditions are a valid uptrend when the long-term trend is still positive. Some traders look for bullish divergences even when the long-term trend is negative, because even though this technique is less credible, it can indicate a change in the trend.

MACD indicator and its signaling

A downward divergence occurs when the MACD forms a set of two declining ceilings corresponding to two high values rising on the price chart.

A downtrend that forms during a long downtrend confirms the likelihood that the downtrend will continue.

MACD indicator and its signaling

Some traders are looking for bearish divergences during long-term uptrends because they can see the signal of weakness in the trend in Makedi. However, this is not as reliable as a downtrend during a downtrend.

An example of a rapid descent or ascent

The rapid decline or rise of the MACD (short-term moving average longer than the long-term moving average) indicates the existence of an oversold or oversold situation in the price of securities, which will quickly return to normal levels.

Traders often combine this analysis with the relative strength index or other technical indicators to confirm the buy or sell conditions.

MACD indicator and its signaling

For investors, using the MACD histogram is not as uncommon as using the MACD itself.

Positive or negative intersections, divergences, and rapid ups and downs can also be identified on the histogram. Investors need to have enough experience in a given situation before deciding on MACD qualification or histogram because there is a time difference between the signals of the two.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading