Forex and CFD broker Plus500 Ltd (LON:PLUS) today issued a trading update for the third quarter of 2023.

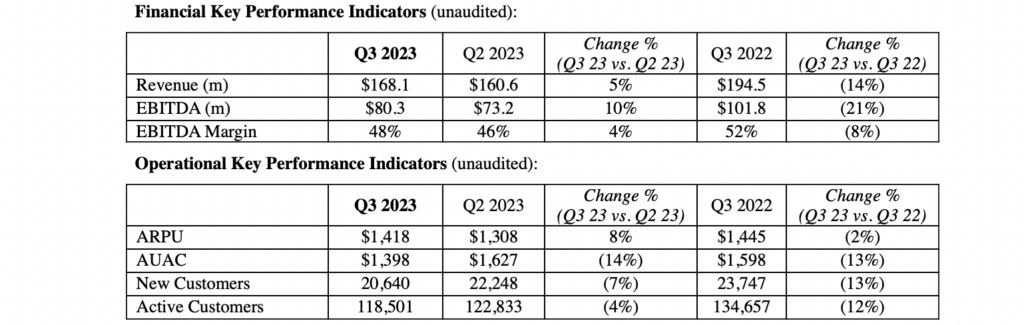

Revenue for the third quarter of 2023 was $168.1 million, down 14% from the year-ago quarter.

Revenue during the first nine months of FY 2023 was $536.6m (YTD 2022: $705.9m).

Customer Income, a key measure of the Group’s underlying performance, was $457.9m in the first nine months of FY 2023 (YTD 2022: $489.2m) including $153.6m in Q3 2023 (Q2 2023: $146.5m, Q3 2022: $149.4m).

Customer Trading Performance in the first nine months of FY 2023 stood at $42.0m (YTD 2022: $216.7m) including $0.1m in Q3 2023 (Q2 2023: $(8.2m), Q3 2022: $45.1m). The Group continues to expect that the contribution from Customer Trading Performance will be broadly neutral over time.

EBITDA in the first nine months of FY 2023 was $254.4m, with an EBITDA margin of 47% (YTD 2022: $407.1m and 58%, respectively). This included EBITDA of $80.3m and an EBITDA margin of 48% in Q3 2023 (Q2 2023: $73.2m with an EBITDA margin of 46%).

The Group onboarded 20,640 New Customers during Q3 2023 (Q2 2023: 22,248) enabled by its diversified marketing approach, targeted technological marketing investment strategy and ongoing structural expansion efforts. This takes the total New Customers for the first nine months of FY 2023 to 71,089 (YTD 2022: 81,022).

The number of Active Customers during the first nine months of FY 2023 was at 205,343 (YTD 2022: 250,553), including 118,501 in Q3 2023 (Q2 2023: 122,833).

Average user acquisition cost (AUAC) during the first nine months of FY 2023 was stable at of $1,463 (YTD 2022: $1,487), including $1,398 in Q3 2023 (Q2 2023: $1,627). With further investments expected to be made going forward, the Group continues to expect that AUAC will rise steadily over time.

Average deposit per Active Customer increased by 25% to approximately $8,500 during the first nine months of FY 2023 (YTD 2022: approximately $6,800) and approximately $5,250 in Q3 2023 (Q2 2023: approximately $4,450, Q3 2022: approximately $3,900).

Plus500 established its strategic presence in the Japanese market via the acquisition of a local, regulated firm. The Group has successfully launched a new proprietary trading platform tailored specifically for the Japanese retail market. The new trading platform was launched in September 2023 and is fully operational, with an initial offering of OTC FX pairings. Over time, the Group will enhance its local offering to include additional asset classes and trading products.

The Group also continues to make good strategic progress in the UAE market following the grant of a regulatory licence from the Dubai Financial Services Authority (DFSA) in Q1 2023. The Group’s customer base in this market is expanding, driven by operational improvements and a deeper understanding of local market requirements.

In July 2023, the Group obtained a new regulatory licence from the Securities Commission of the Bahamas (SCB) which takes the Group’s total to 13 regulatory licences globally and further establishes its position as a global fintech Group.

Comments (0)