Stock Trading Strategies

Many people believe that you should not swim in the opposite direction of the water flow. If these people enter the world of trading, they will definitely become part of those traders who believe in the philosophy of “the trend is our friend and should never be taken in the opposite direction of the trading process “. But others do not. Therefore, based on these two different personalities, two types of trading strategies can be considered; That is, trend-oriented trading strategy and counter-trend-oriented trading strategy.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

★ Trading in the direction of the trend

Trend-oriented trading, also called trend-following, is a type of trading strategy in technical analysis that seeks to make a profit by using price movement analysis in a particular direction. Richard Duncan has been called the father of the trend-following strategy, but it became popular when Richard Dennis and William Eckhart taught it to a novice trading group and named it the Turtles. Following the trend, traders enter buying positions when the trend is up and the market is constantly creating new ceilings, and when they enter sales positions when the trend is downtrend and the market is constantly creating new floors. .

✔ The concept of price return in trading in the direction of the trend

In trading strategies following the trend, it is assumed that the price will continue at its current trend and any sign of a return signal will force the trader to close his position. All traders, including short-term, medium-term and long-term traders, can benefit from this strategy. Regardless of the selected time frame, the trader stays in the trade until he notices the signs of a reversal. However, price returns for different timeframes occur at different times. Therefore, the exit point for a follow-up trader is the return point of the trend.

. Trading Strategies Trading in the direction of the trend

There are several trading strategies for trend trading:

Moving averages: In this strategy, we use two moving averages with different time periods. We enter into a buy trade when the short-term moving average cuts the long-term moving average upwards, and we enter the sell trade when the short-term moving average cuts the long-term moving average downwards.

ت Indicators indicating momentum: In this strategy, we enter the buy trade when the stock price has a strong movement and when it has a weak movement, we enter the sell trade. We can often get help from the MACD indicator .

✰ Chart patterns and trend lines: With the help of this strategy, when the trend is increasing, we enter into a buy trade and place the loss limit below the key support line. In this way, when the price trend is reversed, we can exit the trade with a profit. Regarding chart patterns, it should be said that in this strategy, traders use trend-continuing patterns.

Traders often use a combination of the above trading strategies. A trader may seek to break the channel to confirm the start of a new trend, but enters the trade when the short-term moving average breaks the long-term moving average and a strong downtrend occurs. Of course, to get the maximum return, it is better to combine trend-oriented trading strategies with risk management techniques .

It is important to note that the combination of the above methods creates more confidence in the trader, but trend-based analysis is a powerful analysis that traders can only use to make good profits from the market. Hence, in the following we will talk a little about the trend lines.

✔ Technical analysis based on trend lines

The upward or downward price flow is called a trend and in a general definition the result of price movements in the market is called a trend. Trend analysis is based on the principle that what happened in the past will happen in the future. In fact, it is a method that tries to predict the future price movement with the current price and trend data. Three types of trends can be seen in the market; Uptrend, downtrend and neutral.

What are the uptrend and downtrend?

When prices are rising, the sum of the uptrend and downtrend creates a trend with a positive slope, which is called the uptrend. In the ascending process, each floor that is created is higher than the previous floor and each roof that is created is higher than the previous ceiling. When prices are falling, a negative slope is created, which is called a downtrend, in which each ceiling is lower than the previous ceiling and each floor is lower than the previous floor.

روند Draw the trend line

To draw an uptrend line, we need at least two price floors (the latter should be higher than the first), which can be drawn by connecting them to this type of trend line. The opposite is also true of the downward trend line. That is, we need at least two price caps to draw a downward trend line .

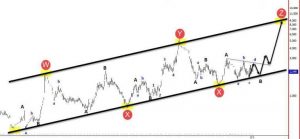

قیمت Draw the price channel

We draw the price channel in order to know what the range of price movements will be and if the channel breaks or the price returns to it, we will receive the necessary signals to enter or leave the trade. Like ascending and descending trend lines, we can draw two ascending and descending channels. An uptrend channel is a price channel that has a positive slope and is drawn using two parallel trend lines. To do this, draw a line parallel to the uptrend line that encloses the ceilings. The downtrend channel also has a negative slope and indicates a fall in prices, and to draw it, we draw a line parallel to the downtrend line that covers the floors.

✔ Ascending and descending channel failure

As mentioned earlier, channel failure can be a signal to enter a trade. Because it indicates a change in trend. For example, in an uptrend channel, if the price hits the bottom line of the channel and breaks it, a sell trade can be entered. However, some traders are waiting for the pullback to be created. In any case, the profit margin can be considered as the width of the channel.

✔ Price return to the channel

This mode can also be a signal to enter the transaction. For example, as shown in the figure below, in an uptrend channel, if the price hits the bottom line of the channel and can not break it and return to the channel, a buy trade can be made. For a downtrend channel, if the price hits the top line of the channel and does not break it, the deal can be sold.

Stock trading strategies based on trends

Of course, it goes without saying that if the price hits the bottom line in the downtrend channel and returns, there are also traders who enter the buy trade. The opposite is also true of the uptrend channel.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

. Neutral trend in technical charts

When prices start to fluctuate within a certain range, two lines can be considered as support and resistance for them. To trade in a neutral trend, two types of trading strategies can be considered. One strategy is to break the support and resistance levels and the other strategy is to return the price from the support and resistance levels.

✔ Failure of support and resistance levels

The failure of their support and resistance is seen as a signal to enter into trades. If resistance is broken, you can enter into a buy trade, and if support is broken, you can enter into a sell trade, but sometimes to be sure, you can use the dominant trend that has already formed a neutral trend. Thus, if the dominant trend is upward and now the resistance is broken, the trader will buy the trade with more confidence, and if the dominant trend is down and the support is now broken, the trader will enter the sell trade with more confidence.

قیمت Price return from support and resistance levels

Because in a neutral trend, you can both buy and sell a deal, if the price hits support and does not break it, you can buy a deal, and if it hits resistance and does not break it, you can also sell a deal.

★ Trading in the opposite direction of the trend

Reverse trend trading strategies, also known as “reverse trading”, are a trading method in which the trader makes small profits by trading in the opposite direction of the trend, and in fact a large part of the movement of the trend. Loses. This strategy is the opposite of a trend-following strategy; Sometimes some good stocks do not work as they should for some reason. So you find these low-performing stocks that you guess will grow soon, and you try to buy them at a low price and on the floor, when everyone is selling them, and as the price goes up, when Sell them on the roof and make a profit.

In reverse trend trading strategies, if you follow the path that others are following, you will miss the right opportunities and will not achieve the desired profit. If you attack it just because others have bought it, you will suffer a loss. Because prices go up a lot when others buy and prices go down a lot when others sell. For example, traders who buy stocks when forming a sell queue and sell stocks when forming a buy queue follow the same strategy. By moving against the prevailing trend, they hope to do their shopping before others buy, and eventually get big sales.

✔ Trading strategy in the opposite direction of the trend

In counter-trend trading strategies, momentum type indicators, trading ranges and return patterns can be used to determine the best area for trading. Traders using this strategy should always be aware that stocks can resume their trend at any time, so they must take risk management techniques seriously; That is, keep the losses as small as possible and take advantage of the appropriate losses. For this reason, it has been said before that these types of traders are trying to make small profits from the market in each trade.

. Advantages of trading in the opposite direction of the trend

More Trading Opportunities: Using a trend-following strategy, when trading in trendy markets to enter into a trade-off only seeks to create pullbacks, it has to hold hands and wait for a long time. But in reverse trading, the trader will have a lot of trading opportunities to buy and sell at support and resistance levels, even when the price fluctuates within a range.

Less Capital Losses: Because traders earn less profits in the opposite direction of the trend, but on a regular basis, they will also experience lower capital losses than trend-following traders.

✔ Trading restrictions in the opposite direction of the trend

. Commissions: The more entry and exit to the market, the higher the transaction costs.

Significance of time: Contrary to trend, traders need to monitor the market regularly to find the best entry and exit points for their trades. Of course, they can overcome this problem by automating transactions.

✍ Concluding remarks

Whether you are a trend trader in trending markets or a reverse trader who does not believe in the famous “your friend trend” philosophy, your goal is definitely to make a profit from capital markets. This will not be possible unless you have a set of rules for trading without using bias in your trading strategy , in which you use strong risk management and know that simplicity comes first in trading, so do not complicate your rules. .

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading