Classic Patterns of Technical Analysis

There are many patterns in technical analysis that understanding them can help a lot in analysis and thus better transactions. Seven classic patterns have been identified in the capital markets, which are highly credible due to the high usage of them. These patterns are easily recognizable in the capital markets, but it is necessary to know the patterns correctly. Also, these classic patterns are formed in different time frames (time periods), but they are most used in daily time.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Classic patterns: shoulder pattern

One of the classic patterns is called head and shoulders. This pattern is considered one of the classic return patterns. When a symbol is in the ascending direction, if this pattern is formed, it مسیر changes direction and moves down. The opposite is true in which the stock is in a downward trend and then the shoulder pattern is formed and the downtrend changes direction and returns upwards. There are conditions for forming this model, which are mentioned below.

Components of the shoulder pattern

- Head (has the highest peak in the pattern)

- Shoulders (two combs that may be ideally the same size and can be flat or non-flat).

- Neckline (the line that joins the two points resulting from the joining of a string and a shoulder, and is our criterion for accurate pattern recognition.)

Now let’s look at the pattern, this pattern is ideally as follows:

The same is true for the descending state. Consider the following examples:

Types of patterns in technical analysis

Types of patterns in technical analysis

Ascending shoulder pattern

Types of patterns in technical analysis

Descending shoulder pattern

Types of patterns in technical analysis

Sometimes your model’s price target may not be met for reasons such as previous support and other support or resistance.

As we explained to you earlier, this pattern will be considered a neckline failure when it can cross the line with a high trading volume or trading gap or with an empty candlestick and can trade above it for three trading days. Became; But this pattern has never been achieved in this share, because the neckline has not been broken under the conditions described!

Types of patterns in technical analysis

Types of patterns in technical analysis

Question: Do we see a bullish pattern in the chart below?

According to the figure below, two points are important, first, that the trend before the pattern is downward, but much smaller than the pattern itself, the second point is that the neckline is not broken.

Types of patterns in technical analysis

Classic Patterns: Twin Ceilings

This pattern is the same as the shoulder pattern of a recursive pattern, to identify this pattern, it is enough to find a pattern like the one below in our diagrams.

Types of patterns in technical analysis

As you can see, if there is an uptrend and such a pattern is created, if the stock moves out of point A downwards, in other words, intersects the neckline with a large volume, the price target will be equal to the distance from the pattern ceiling to the neckline. .

Types of patterns in technical analysis

Classic patterns: triple ceiling

This pattern, like the twin roof pattern, is a reversible pattern and only becomes triple instead of twin, in other words, it becomes “three ceilings or floor” instead of “two ceilings or floors”. This pattern is also true for the opposite case, the triple floor.

Consider the following example:

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

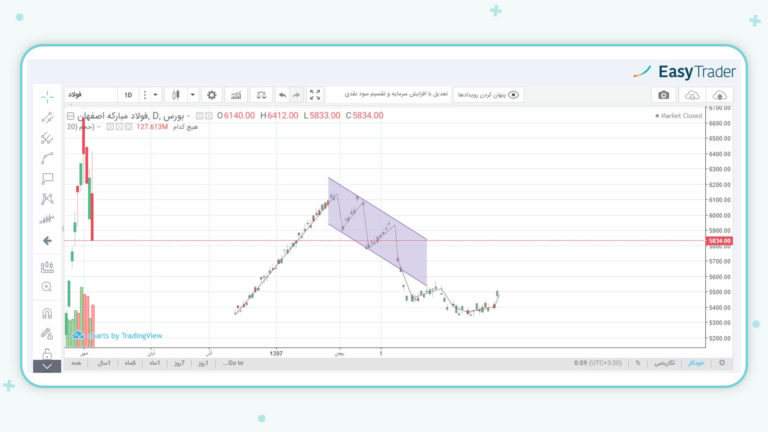

Classic Patterns: Flag Pattern (FLAG)

This pattern is one of the continuing patterns in technical analysis, ie the share in the ascent circuit enters the flag pattern and then continues to move with a specific price target.

There is a similar pattern of flags in the downtrend.

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

This pattern will sometimes change the trend in a stock! When the share enters the template and exits the template in reverse, it changes the trend. In the image below you can see the original example for a flag, if it exits point A, it acts continuously and if it exits point B, it acts reversibly.

Types of patterns in technical analysis

As you can see in the pictures below, consecutive and continuous flags are formed in the specified interval.

Types of patterns in technical analysis

Types of patterns in technical analysis

Price Tips and Targets

- The flag pattern consists of a flag and a handle

- In case of failure in the continuation of the process, it acts as a continuous pattern and otherwise a reversal.

- The first price target is the size of a flagpole and the second price target is shaped like a channel

- The length of the flag should not exceed 50% of the ideal flagpole.

- This pattern is more common in rallies (consecutive ascents or descents).

The flag is back

Types of patterns in technical analysis

Classic Patterns: Triangles

There are different types of this pattern, but in general, if we can draw two lines convergently to form a triangle, this part of the pattern counts. This pattern can be recursive or continuous.

Price targets

The price targets in the triangle pattern are as high as the H side in the shapes, and if the stock exits from either side of the triangle, it will advance as much.

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

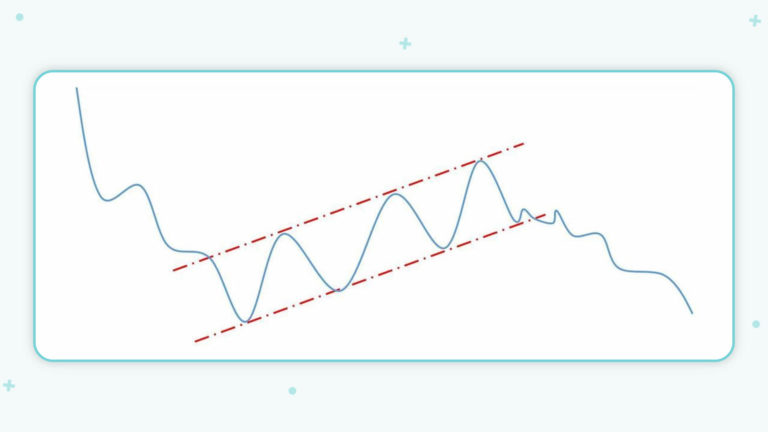

Classic Patterns: Wedges Pattern

This pattern is the same as a triangle, except that it is formed as an angle and its rules are in accordance with the triangle.

Types of patterns in technical analysis

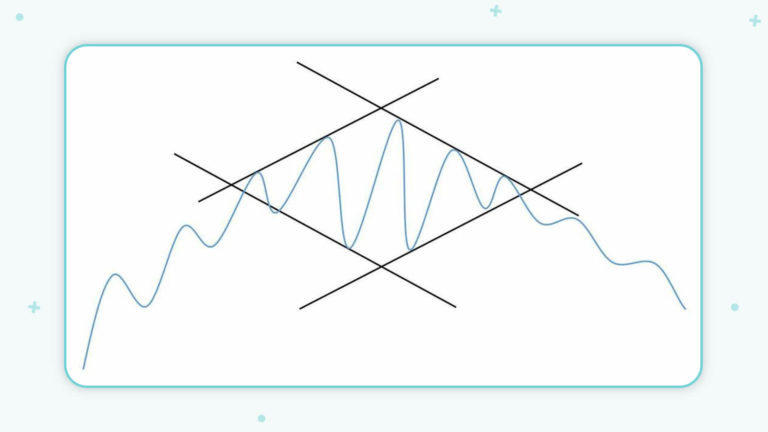

Classic Patterns: Diamonds

This pattern is reversible and if the share in the uptrend enters this pattern, it will decline and this pattern is the opposite.

Types of patterns in technical analysis

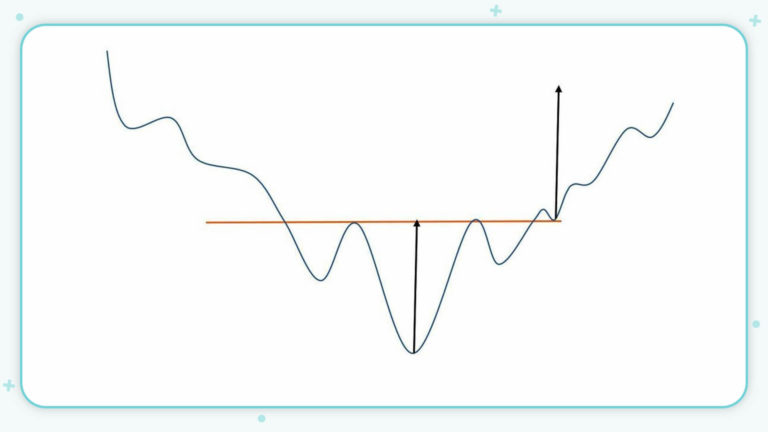

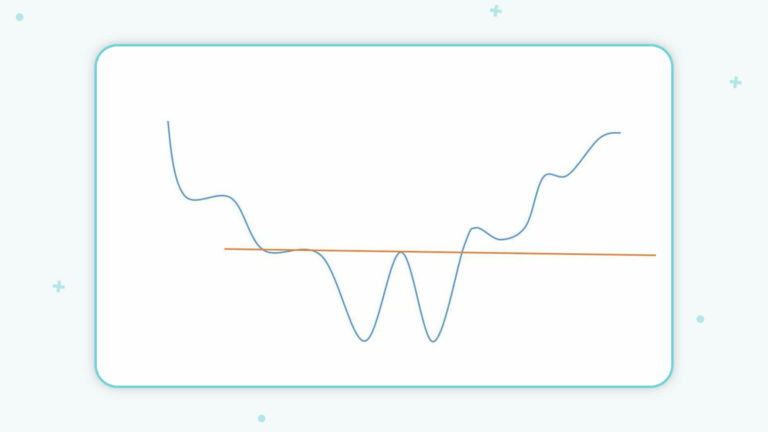

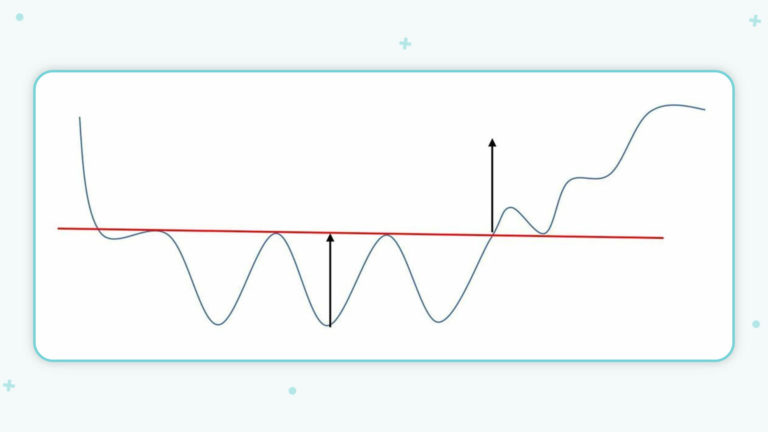

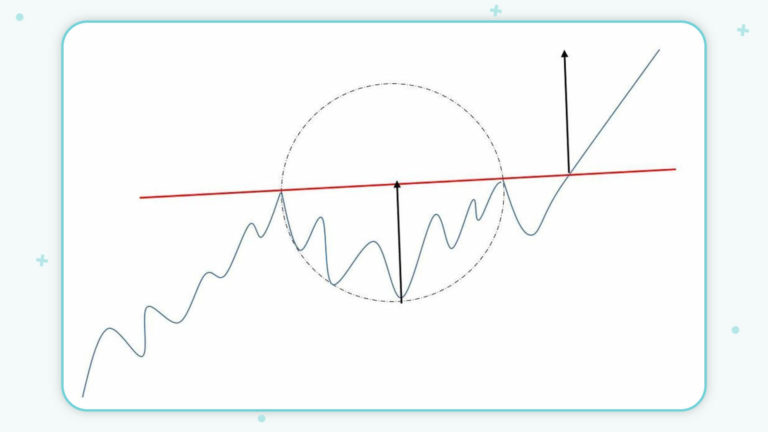

Classic Patterns: Cup and Handle Pattern (CUP)

This pattern is used to continue the uptrend, in such a way that the stock enters the cup and if it exits, it will grow to the bottom of the pattern. This template can be formed simply and without a handle, but usually a small bunch is formed on the right side of the template. According to the figure below, the share has entered the pattern in the ascending path and has continued to its path after forming the handle on its right side and crossing the neckline.

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

Types of patterns in technical analysis

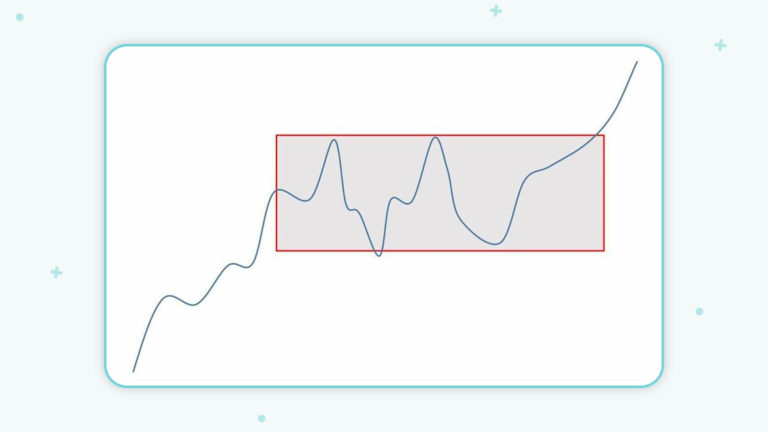

Classic Patterns: Rectangular Pattern

This pattern can also be ascending or descending depending on the exit of the stock, so that according to the image below, the stock could grow to the width of the rectangle after crossing the resistance range.

Types of patterns in technical analysis

Types of patterns in technical analysis