As we said in the past, using Fibonacci levels can be very tasteful. This means that one trader may draw them from the ceiling and floors A and B and another trader from points C and D! However, there are ways you can increase the odds in your favor.

Although the Fibonacci breeding tool is very useful, it should not be used alone.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Similar to NBA legend Kobe Bryant.

Kobe was one of the greatest basketball players in history, but even he could not have won these honors on his own.

He needed support.

Likewise, the Fibonacci correction tool should be used in combination with other tools.

In this lesson, let’s try to combine what you have learned so far so that you can reach the sweet trading mechanism and settings.

Are you ready? So join us!

Corrective Fibonacci + Support and Resistance

One of the best ways to use correctional Fibonacci tools is to identify potential levels of support and resistance and see if they are compatible with correctional Fibonacci levels.

If Fibonacci levels are above support and resistance levels, and you combine them with other price areas that many other traders are monitoring, the price is much more likely to react to those areas.

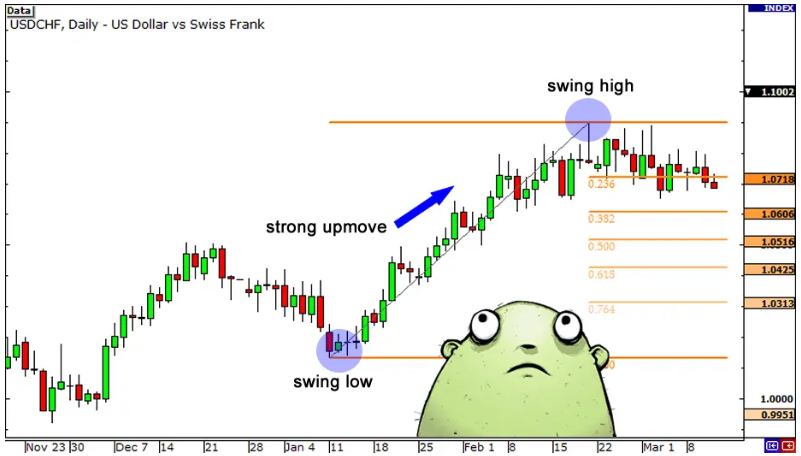

Let’s look at an example of how to combine support and resistance levels with Fibonacci levels. Below is the daily USD / CHF chart.

Use corrective Fibonacci with support and resistance lines

As you can see, it has been on the rise lately. Look at all those green candles!

You decide to take the USD / CHF train.

But the question is, “When are you coming in?”

You open the Fibonacci correction tool and set the lowest level at 1.0132 on January 11 for the floor and the highest level at 1.0899 on February 19 for the ceiling.

Now your chart looks very sweet with all those Fibonacci levels of correction.

Use corrective Fibonacci with support and resistance lines

The entry point of the transaction

Now that we have a framework to increase the likelihood of achieving a solid entry, we can ask the question, “Where should we enter?” Let’s answer.

Look back a little. You can see that the price of 1.01010 has been a good resistance level in the past and coincidentally with 50.0% of the Fibonacci correction level.

Now that it is broken, it can become a support and a good place to shop.

If you place the order around 50.0 Fibonacci, you are relieved!

You are probably experiencing very stressful moments, especially on the second touch of the support level on April 1st.

Use corrective Fibonacci with support and resistance lines

The price tried to pierce the support level but could not close below it. Finally, the pair crossed the ceiling and continued its upward trend.

You can configure the same mechanism in descending order. The point is, you need to look for price levels that seem to have been areas of interest in the past.

The reason for the price reaction to the corrective Fibonacci levels

If you look closely, you will see that prices are more likely to react to these levels.

Why?

First, as we discussed in previous lessons, previous levels of support or resistance in areas are usually good for buying or selling because other traders, like the Eagle, monitor these levels.

Secondly, since we know that many traders also use Fibonacci correction tools, they may be looking to use and enter these levels themselves.

Where traders look at the same support and resistance levels, it is likely that there will be large volumes of orders at that price level. Market fluctuations are also a function of supply and demand.

Although there is no guarantee that the price will react to that level, you can at least trade with more confidence. After all, there is power in these numbers!

Remember that trading means talking about possibilities .

If you try to trade more likely, you are more likely to succeed in the long run.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading