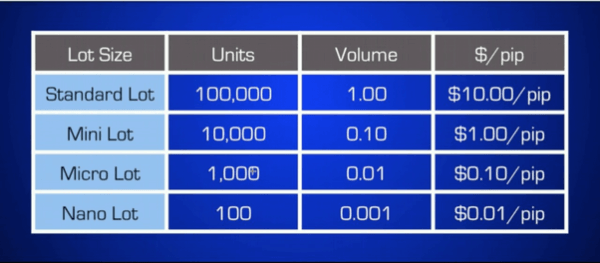

Forex is usually traded in certain amounts called “lots”. In fact, the unit of measurement is the volume of trades in Forex Lot. The standard size for a lot is 100,000 units of base currency, and there are currently mini, micro, and nano sizes that are 10,000, 1,000, and 100 units, respectively.

Some forex brokers indicate quantity and quantity as “lot” and some brokers indicate the currency units themselves. You can see the titles of this article in the table below.

In the previous lesson, we explained what a pip is in Forex, and you knew that changes in the value of one currency relative to another currency are measured by a “pip,” which is a very, very small percentage of the value of a unit of that currency. To take advantage of this small change in value, you have to trade large amounts of a particular currency to make an acceptable profit or loss . Because normally fluctuations in the foreign exchange market are very small and trading with a small volume is not justified.

We have already explained how to calculate the pip value for each currency pair. Suppose we intend to trade in EUR / USD:

- If we trade with a standard lot (100,000), each pip change has a profit or loss of $ 10.

- If we trade with a mini lot (10,000), each pip change has a profit or loss of $ 1.

- If we trade one microlat (1,000), each pip has a profit or loss of 0.10.

- And if we trade one nano-lot (100), each fluctuation pipe has a profit or loss of only $ 0.01.

What is a lot in Forex? What is Leverage in Forex?

As the market and prices move, the value of the pip may change depending on the currency you are trading.

What is Leverage in Forex?

$ 100,000, or even $ 10,000, is too much for many. You may be wondering how a small investor like you can trade such a large amount of money. Think of your broker as a bank that gives you $ 100,000 to buy currency. All the bank has to do is ask you to make a $ 1,000 deposit in good faith. This amount is kept for you but is not necessarily saved. This amount will increase or decrease with your profit and loss in transactions .

Sounds pretty good? Trading Forex with leverage (leverage) is exactly the same way.

A key question: How good are brokers? Do they borrow this heavy amount without taking interest ?! The answer is simple! Brokers receive commissions from your trades and the higher your trading volume, the more commissions they will receive, so when they lend to you you will have a higher trading volume and as a result the broker will make more profit. Just as easily! 🙂

The amount of leverage you use depends on your broker and convenience. Sounds pretty good? This is exactly the way to trade Forex using leverage.

Forex brokers typically ask you for a deposit called a “margin”.

How to use leverage in MetaTrader

Once you have deposited your money, you can start trading. The broker also determines how much margin is needed for each traded position (in lots). For example, suppose a leverage is 100 (or 1% of the trade required) and you want to get a trade worth $ 100,000, when you only have $ 5,000 in your account.

No problem because your broker will set aside $ 1,000 as a deposit and allow you to “borrow” the rest. Definitely any profit will be added to the cash balance in your account or deducted in case of loss. The minimum margin required for each lot is different in each brokerage. The leverage you choose also has a direct impact on the required margin.

In the example above, the broker needed a. Margin. This means that for every $ 100,000 traded, the broker demands $ 1,000 as a deposit for each trade. Suppose you want to buy 1 standard lot (100,000) USD / JPY. If your account has 100 leverage, you should consider $ 1,000 as a margin. Note that $ 1,000 is not a deposit, but a deposit.

So when you close your deal, they will give it back to you. The reason the broker asks you to make a deposit is that as long as the trade is open, there is a risk that you will lose money while the trade is open ! The broker will keep this deposit to compensate for your possible loss.

Assuming this USD / JPY transaction is the only game transaction you have in your account, you must have $ 1,000 in your account as long as it is open and you are not allowed to withdraw it. If USD / JPY falls and your trading losses cause your account balance to fall below $ 1,000, the brokerage system will automatically close your trading before your losses reach $ 1,000 to prevent further losses.

This is a safe mechanism to prevent your account balance from becoming negative. Understanding how to deal with margins is very important and we will discuss it later in the full section. If you do not want your account to be destroyed, we strongly recommend reading that section!

How do we calculate profit and loss?

Now that you know how to calculate the value of a pipe and leverage, it is best to know how to calculate profit or loss.

In general, the number of pipes fluctuates * The value of each pipe = your profit or loss

Let’s buy US dollars and sell Swiss francs.

- The quote rate offered to you is: 1.4525 / 1.4530 Since you are buying US dollars, you are working on the suggested selling price of 4530. This is the rate at which the broker sells to you.

- Summary You buy 1 standard lot (100,000 units) at 1.4530.

- A few hours later, the price reaches 1.4550 and you decide to close your trade.

- The new USD / CHF exchange rate is 1.4550 / 1.4555. Since you first made a purchase to open trades, you now have to sell to close trades. Therefore, you should use the “BID” price, which is 1.4550. The rate that the broker gives you for sale.

- The difference between 1.4530 and 1.4550 is 0.0020 or 20 pips.

- We calculated the value of each pipe according to the formula of the previous lesson and it is equal to $ 6.87.

- Using the above formula, we now have:

20 * 6.87 = $137,404

Your profit from this trade is $ 137.40.

Spreads and Bid / Ask rates

Lot application in MetaTrader

We have already explained and due to the importance of the article, we remind you once again. Spread is the difference between the purchase or sale price. This is the commission of Forex brokers from your trades. When you buy a currency pair, you use the ASK price. And when selling, you will use the BID price. Keep these in mind as they are very important for calculating profit and loss limits.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading