If you are looking to choose a broker, read this article. The first step in choosing a broker is to know what your choices are. When you enter a restaurant, you do not immediately know what to order, right? Of course, unless you are a regular customer there. In most cases, when you enter a restaurant, you first check the menu to see what they have to offer. The same is true for forex brokers. You first need to know what options you have and know the types of brokers.

There are two major types of forex brokers:

- Broker with trading table (DD)

- Broker without transaction distinction (NDD)

To brokers with trading desk, Market Maker (Market Maker) is also called. Also, the types of brokers without trading table are:

- STP Brokers

- ECN + STP brokers

What is Forex Market Broker and NDD Forex Broker?

What is a market maker or broker?

Forex brokers who operate through the trading table (DD) earn money through spreads and providing liquidity to their clients. This type of brokers Market Maker or market maker is also called. Brokers with a trading desk literally create a market for their clients, meaning that they often take the other side of the client transaction. You might think that in this case, the broker’s profit is to the detriment of the client, but this is not the case.

Market makers offer both selling and selling prices, meaning that they execute both buy and sell orders for their customers. They are indifferent to the decisions of an individual trader. As a result, it does not matter whether a particular trader gains or loses.

Because market makers control the prices at which orders are filled, it can be concluded that setting up a fixed spread is of little risk to them (you will find out later why a fixed spread can Be better).

Also, clients of brokers with trading tables do not see real interbank market rates, but do not be afraid. The competition between brokers is so fierce that the rates offered by brokers at the trading table are close to interbank rates, if not exactly the same.

Working Principles in Trading Maker Brokers

For example, you order a broker with your trading table to buy for 100,000 EUR / USD. To complete your transaction (ie, place your purchase order), your broker first tries to find a suitable sell order with your purchase from other clients. If no such order is found, the transaction will transfer you to your liquidity provider. Liquidity Provider is a large and reputable global institution like large banks that easily buy and sell financial assets.

By doing this, they minimize the risk, because they make money from the spread without taking over the other side of your trade. However, in the absence of matching orders, they will have to take over the other side of your deal.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Types of Brokers – No Trading Table

What is NDD?

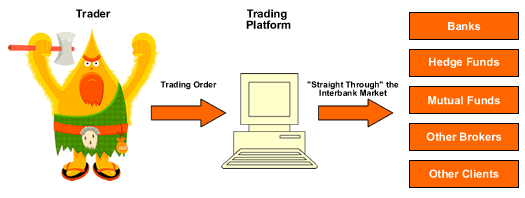

As the name implies, brokers without a trading desk (NDD) do not process their clients’ orders through the trading desk. This means that they are not on the other side of their customers’ transactions and only link the two parties to the transaction.

What is Forex Market Broker and NDD Forex Broker?

NDD brokers are similar to bridge builders: they create a structure to connect two hard-to-reach areas. NDDs can also receive very little commission for a transaction or, with only a slight increase in spreads, the so-called markup. Forex broker without trading table can be both STP and STP + ECN, which we will explain below.

What is STP Broker in Forex?

Some brokers claim that they are real ECN brokers, but in reality, they only have one STP system. STP-enabled forex brokers direct their clients’ orders directly to their liquidity suppliers, who have access to the interbank market.

Brokers without a STP usually have a lot of liquidity, and each supplier has its own selling price and buying price. For example, your STP broker without a trading desk has three different liquidity providers. In their system, they will see three pairs of bids.

Their system then sorts these buying and selling prices from best to worst. In this case, the best price on the buy offer side is 1.3000 (you want to sell at the highest price) and the best price on the sell offer side is 1.3001 (you want to buy at the lowest price). Currently, the buy / sell rate is 1.3000 / 1.3001.

Is this the price you see on your platform? of course not! Your broker will not work unless God willing! Your broker does not sort prices for free. At the same time as sorting prices, your broker adds a small amount, usually a fixed amount, to prices. If their policy is to add 1 pip, the price you see on your platform will be 1.2999 / 1.3002.

You will see a spread of 3 pips. A 1 pip spread becomes a 3 pip spread for you. So when you decide to buy 100,000 EUR / USD at the price of 1,3002, your order will be sent through your broker and then transferred to liquidity provider A or B.

If your order is approved, liquidity supplier A or B will be able to buy EUR 100,000 / USD 1,3001 and you will be able to sell EUR 100,000 / USD 1,3002 . Your broker will earn 1 pip.

This bid / sell price change is also due to the fact that most STP brokers have variable spreads. If the spreads of their liquidity suppliers increase, they have no choice but to increase their spreads. Although some STP brokers offer fixed spreads, most have variable spreads.

What is Forex ECN Broker?

Real ECN brokers, on the other hand, allow their clients’ orders to interact with the orders of other ECN participants. Participants can be banks, small traders, hedge funds and even other brokers. In short, the participants trade with each other by offering the best bid and ask prices.

ECN also allows its customers to see the depth of the market. Market depth indicates what other market participants’ buying and selling orders are. Due to the nature of the ECN, it is difficult to add a fixed value to the spread. Thus, ECN brokers usually earn a small commission per transaction.

Is Market Maker Bad?

Unfortunately, this is not always true in the Forex market. Many traders think that market maker brokers are hurting them. Why? Because they have heard that the other side of the market is taking over their deal. So the broker’s profit is to their detriment.

But this is not true. Because market makers do not always take the other side of transactions and in most cases cover it with transactions of other customers. Even if they do not find a suitable order, they usually transfer their liquidity to the supplier.

Of course, in the Forex market, like all financial markets, the presence of fraudsters is inevitable. If you are not careful in choosing your broker (you do not need to be obsessive) you may fall into the trap of fraudsters.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading