Forex brokers offer two different prices for a currency pair: the BID price and the ASK price. “BID is the price at which you can sell the base currency. “ASK is the price at which you can buy the base currency. In this article, Forex spreads will be fully explained. You can use the table below to select the desired topic.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

What is Forex Spread?

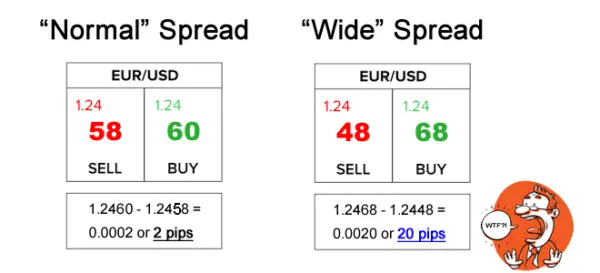

The price difference between Bid and Ask is called the spread , which is also called the “BID / ASK price spread”. In other words, spreads are actually the answer to the question, where does a “no commission” broker earn his money from? Instead of charging a separate fee for trading, this fee is placed at the heart of the buying and selling rate of the currency pair you want. From a business point of view, this makes sense. The broker provides the service and must earn some money.

- They make more money by selling you currency than they buy for the same currency.

- They also earn money by buying currency from you for less than their sales amount.

- This difference in buying and selling rates is called a spread.

It’s like trying to sell your old iPhone to a store that buys second-hand iPhones. To make a profit, this store must buy your iPhone at a lower price than the one it sells. In other words, if he wants to make money and sell the iPhone for $ 500, the maximum he can buy from you is $ 499. This $ 1 difference is called a spread. So when a broker says “zero commission” or “no commission”, it is a bit misleading because even though there is no separate commission fee, you are still paying the commission. Only this commission has hidden itself in the heart of the spread!

How to calculate spreads in Forex

What is Forex Spread?

Pairs of currencies denominated in Japanese yen are only up to 2 decimal places (unless pricing is less than 1 pip, in which case 3 decimal places are specified). For example, if USD / JPY is equal to 110.00 / 110.04. This rate indicates a spread of 4 pips.

Types of spreads in Forex

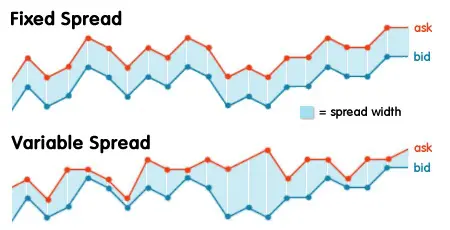

The type of spread you will see in your trading software depends on the broker and how they earn money. There are two types of spreads:

- Fixed

- Variable or floating

What is Forex Spread?

Fixed spreads are usually offered by brokers who act as market makers or act as a “trading table” model. Variable spreads, on the other hand, are offered by brokers using the “no trading desk” model.

Fixed spreads in Forex

Fixed spreads remain constant at all times, regardless of market conditions. In other words, whether the market is as volatile as Master Tataloo or as calm as a mouse, the spread will not be affected. It remains the same. Fixed spreads are offered by brokers who act as a market maker or “trading table” model.

Using the trading desk, the broker buys many trading opportunities from his Liquidity Provider and offers these opportunities to traders on a smaller scale. This means that the broker acts as the counterparty in his clients’ transactions.

Having a trading desk allows the Forex broker to offer a fixed spread, as they are able to control the prices they show to their clients. If you want, you can learn more about different types of Forex brokers.

Fixed spread benefits

Trading in fixed spread accounts requires less initial deposit, so trading with a fixed spread is a cheaper option for traders who do not have much money to start trading Forex. Fixed spread trading also makes the calculation of trading costs more predictable. Because spreads never change, you can always be sure of what you will pay when you open a trade.

Disadvantages of fixed spreads in Forex

When trading fixed spreads, ricochets may occur frequently because pricing comes from only one source (your broker). Ricotta in Forex means canceling your order at the previous price and offering a new price due to a price change. There are times when the Forex market is volatile and prices are changing rapidly. Because the spreads are fixed, the broker will not be able to increase the spreads to suit the current market conditions. So if you want to enter into a price deal, the broker will “cancel” the deal and ask you to accept the new price. Then you will be “re-priced or ricotted” with the new price.

A requote message appears in your trading software informing you that the price has been moved and asking you if you would like to accept the new price. The price is almost always worse than the price you ordered. Slipage is another problem, although it is not limited to fixed spreads. When prices go up fast, the broker is constantly unable to deliver prices quickly, and the price you eventually get after entering a trade may be different from the price you initially wanted to enter.

Floating spreads

As the name implies, floating or variable spreads are always changing. With variable spreads, the price difference between BID and ASK is constantly changing. Floating spreads are offered by brokers without a trading desk, and these brokers receive their pair prices from a variety of liquidity providers. They transfer these prices to their traders or customers without the intervention of the trading table.

This means that they have no control over the spreads and the spreads increase and decrease based on the supply and demand of currencies and general market fluctuations. Normally, the spread spread widens, ie increases when economic information is published, as well as when liquidity in the market decreases (such as holidays and midnight, etc.).

What is Forex Spread?

Spreads can increase up to 10 times when economic news is published. For example, suppose you want to buy EUR / USD with a 2 pp spread, but just when you want to click buy, the US unemployment report is published and the spread quickly reaches 20 pips! Or when Trump suddenly tweets about the US dollar, the spread may increase.

Advantages of trading with floating spreads

Variable spreads eliminate ricotta. This is due to changes in spread components and changes in price depending on market conditions (but just because you do not receive ricotta does not mean that you do not experience slippage). Floating spread forex trading also provides clearer pricing, especially when access to pricing from multiple liquidity providers usually means better pricing due to competition. When you use accounts with variable spreads, you usually pay less in total than a fixed spread account.

Disadvantages of Forex Floating Spreads

Variable spreads are not ideal for scalpel. Increased spreads in times of severe market volatility can quickly swallow Scalpel’s profits. Scalpers are traders who open and close their trades in minutes or even seconds. Variable spreads are just as bad for economic news traders. Because when economic news is published, the spread may widen (increase) to such an extent that a trade that is profitable jumps in the blink of an eye. Also, one of the disadvantages of variable spread accounts is that because they generally use the order processing type in the market price, you have no control over the slip tables.

Compare and select the type of spreads

The question of which is better between fixed and variable spreads depends on the needs of the trader. There are traders for whom fixed spreads may be better than variable spreads. The opposite may also be true for other traders. In general, traders with smaller accounts and fewer trades are better off with fixed spread pricing, and traders with larger accounts are more likely to trade continuously during peak hours (when spreads are at their lowest). They use variable spreads. Traders with variable spreads are better off for traders who want to execute the trade quickly and should avoid rejecting the request or ricotta.

Calculate spreads

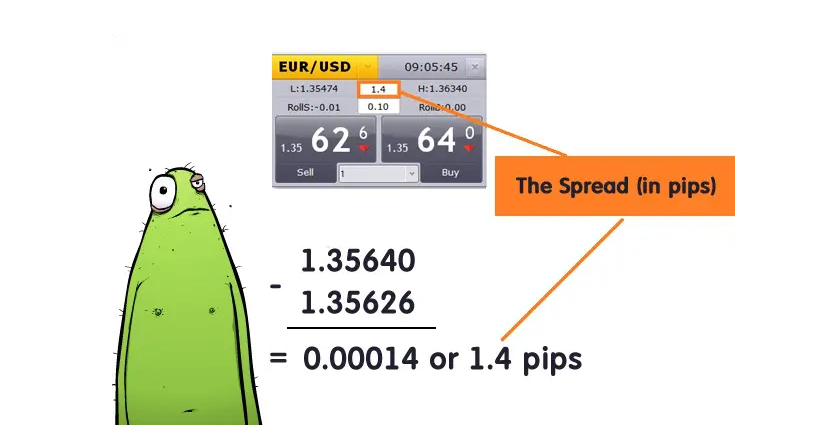

Now that you know what spreads are and you know two different types of spreads, you need to know one more thing. How the spreads relate to the actual transaction costs. It is very easy to calculate and you only need two things:

- The amount or value of each pipe

- The number of lots you trade.

Let’s look at an example…

What is Forex Spread?

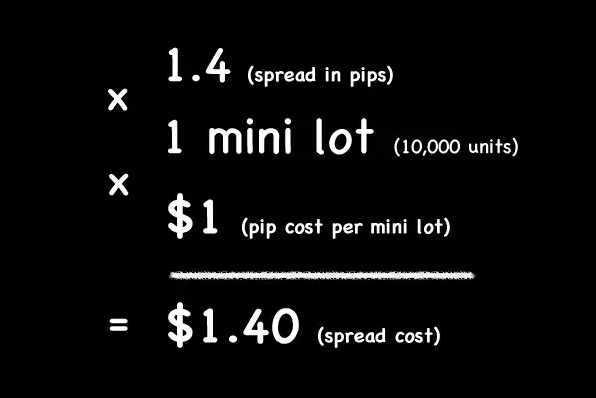

At high pricing, you can buy EUR / USD for 1.35640 and sell EUR / USD for 1.35626. This means that if you try to buy EUR / USD and close it immediately, you will lose 1.4 pips. To calculate the total cost, multiply the cost per pip by the number of lots you trade. So if you are trading a mini lot (0.1 lot), the value of each pip is $ 1. So the cost of your trade to open this trade is $ 1.40.

What is Forex Spread?

The cost of the pipe is linear. This means that you have to multiply the cost of each pipe by the lots you trade . If you increase the size of your trade, the cost of your trade, which is reflected in the spread, will also increase. For example, if the spread is 1.4 pips and you trade 5 mini lots. Your transaction will cost $ 7.00.

What is Forex Spread?

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading