Now we come to the part where we talk about the middle ground: what is the best Forex indicator? How profitable is each technical indicator in itself?

However, Forex traders do not use these technical indicators just to beautify their charts. Traders are looking to make money!

If these indicators produce signals that are ultimately unprofitable, then they do not meet your needs!

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Our test (the so-called forex test) involves testing the parameters of indicators against price movements in the past.

We will talk more about this in future lessons. For now, just look at the parameters we used for the backtest.

Indicator settings to test the best indicator

| Indicator | parameters | Transaction rules |

|---|---|---|

| Bollinger Bands | (30.2.2) | Shop when the daily closing price goes below the bandwidth. Sell when the daily closing price crosses the high bandwidth |

| MACD | (12,24.9) | When a fast sucker, cut the slow sucker and go on top of it. When a fast sucker cuts a slow sucker and goes under it, sell it |

| Parabolic SAR | (.02,.02,.2) | Shop when the daily closing price goes above the parabolic star. Sell when the daily closing price goes below the parabolic star |

| Stochastic | (14,3,3) | Buy when the stochastic percentage goes above 20. Sell when the stochastic percentage falls below 80 |

| RSI | (9) | Buy when the RSI goes above 30 and sell when the RSA goes below 70 |

| Ichimoku | (9,24,52,1) | When the shift line crosses the baseline and goes above it, make a purchase. When the conversion line goes below the baseline by cutting the baseline, sell |

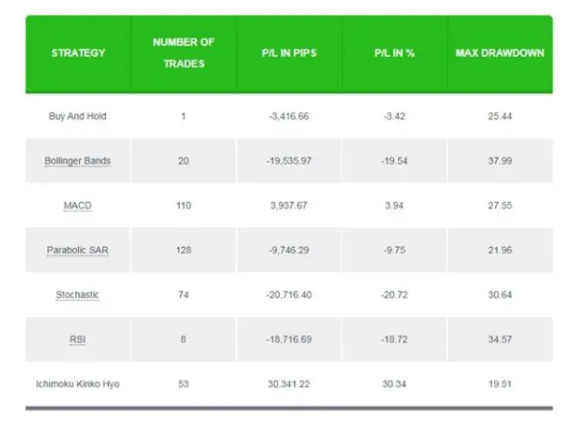

Using these parameters, we tested each of the technical indicators individually and on a daily basis on the EUR / USD pair over the past 5 years.

We traded 1 lot each time (ie 100,000 units) and did not set a loss or profit limit.

Each time a new signal appeared, we took a new position and left the previous deal. This means that if at first we had a buy position and the indicator told us to sell, we would do so and sell.

Also, we assumed we had enough inventory (according to the Leverage Lesson tutorials) and so we started with a hypothetical inventory of $ 100,000.

In addition to the actual profit and loss of each strategy, we also recorded the total profit / loss pips and the maximum down (capital loss).

Test results for the best Forex indicator

We remind you once again that we never offer Forex trading without a loss limit. This is done only for the purpose of better explanation! By the way, the following back test results are presented:

What is the best Forex technical indicator? Comparison of indicators

The data showed that over the past 5 years, the indicator that has performed best is the Ichimoku indicator.

He made a total of $ 30,341, or 30.35%. Over a period of more than 5 years, it has given us an average profit of more than 6% per year!

Surprisingly, the rest of the technical indicators were much less profitable. The lowest was the stochastic indicator, which had a negative return of 20.72%.

In addition, all indicators led to a significant drop in capital between 20 and 30%. We will talk more about money laundering and capital loss later.

Is the Ichimoku indicator the best forex indicator?

Although Ichimoku performed better in our test, this does not mean that the Ichimoku Kinko Hyo indicator is the best indicator or that all other technical indicators are useless. Rather, it shows that they alone are not very useful in themselves.

Imagine all the football greats you remember from your childhood. None of them relied on just one shot to score. They used a combination of movements and techniques to score goals.

Forex trading is similar. It is an art, and we as traders must learn how to use the available tools and combine them so that we can arrive at a system that works for us. In the last lesson of Forex training, we discussed how to combine several indicators.

Tips on Forex Indicators

Regardless of the test we performed, there are important points in working with indicators that we suggest you read carefully.

1. Indicators are a tool to help the trader

Forex indicators are just a tool to help the trader. what does it mean? This means that you only have to look at it through the eyes of an auxiliary tool. You should not expect miracles from indicators, and it is not at all the case that you can make a profit just by using 1, 2 or 3 indicators. In many cases, novice traders are more misled by the incorrect use of indicators.

2- Do not look for strange indicators

Note that it is supply and demand that cause prices to fluctuate. So to be successful, you need to know when the supply market is going up and when the demand is going up. How do we know when others are buying and selling? If you use the same method that most people use, you can know when they are buying and when they are selling.

An example: The Moving Origin indicator is one of the most common indicators of technical analysis. Assuming that Moving signals the purchase of the Euro-dollar at 1.2450, it can be inferred that at 1.2450 the demand for buying will rise. Many traders use the Moving Origin signal.

Now suppose you are using the XYZ indicator and you bought this indicator at a great price! The signal that your indicator gives you will get you and a few people who use this indicator, which may be exactly the opposite of the majority direction, and that means you sold where you should have bought.

3- Do not be indicator-oriented

Many traders believe that indicators are basically useless. You can find trading fans with blank charts everywhere. They believe that trading requires nothing but charts and charts, everything lies in charts.

At the moment we are not trying to reject or approve them, but our point is not to be so salty and not like those who see everything in the indicators. Unwarranted and unnecessary prejudice will destroy you.

Summary of the best Forex indicators

Indicators are good tools to help traders but they are just tools. We looked at the most commonly used indicators, and in our test the Ichimoku indicator performed better, but as we said, this can not be a criterion for the best Ichimoku. You may change the settings if you do this test again, this time the MACD will answer better. On the other hand, the indicators that were lost in our test may have a positive return with another setting.

In general, we do not have anything called the best Forex indicator. If you are going to use indicators, it is better to choose several indicators and test them with your trading system. Whichever indicator you communicate better with and perform better, that indicator is the best Forex indicator for you.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading