Description

Hikkin-Ashi trading strategy and the reasons for its popularity among traders

Topics of this article

- 1 Heiken-Ashi Trading Strategy

- 1.1 The function of the Hicken-Ash diagram

- 1.2 How to deal with this chart?

- 1.3 Examples of strategies and images

Hykyn-Ashi Trading Strategy ( Heiken – Ashi )

The Hickey-Ash diagram is similar to a candlestick (or candlestick) diagram, but the method of calculating and plotting candlesticks in a Hykin-Ash diagram is different from a candlestick (or candlestick) diagram. This chart shows the sales settings. This is one of the favorite strategies in the trading market.

In the candlestick chart, each candlestick shows four items:

- Starting price (Open)

- Closing price (Close)

- Highest price (High)

- Lowest price (Low)

Insert >>> indicator >>> custom >>> Heiken-Ashi

Hickin-ash candlesticks are different and each candlestick is designed and calculated based on its previous candlestick information, ie:

- Closing price : Kendall Hikkin-Ashi is the average of the starting, closing, highest and lowest prices.

- Starting price : The Hickin-Ash candle is the average of the starting and ending price of the previous candlestick.

- Highest price: The highest price in Kendall Hikkin-Ashi is selected from the highest price, the starting and ending price that has the highest value.

- Lowest price : The lowest price in Kendall Hikkin-Ash is selected from the lowest price, the starting price and the end price that has the lowest value.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Hickey-ash candlesticks are related because the start and end price of each candle is calculated using the start and end price of the previous candlestick, and the highest and lowest price of each candle is influenced by its predecessor candle.

The Hickey-Ash chart moves slower and gives a delay signal than the candlestick chart (such as when we use moving averages (MA) in the chart to trade).

This strategy can be useful in many volatile price movements.

This daily strategy is very popular in the trading market for several reasons.

It is a very simple method to identify and the trader has to wait for the final price of the candlestick and then the new candlestick that is being filled.

These days, you can use the Hickey-Ash indicator in any chart.

The function of the Hicken-Ash diagram

Now let’s take a look at how the Hickey-Ashie chart works.

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

How to deal with this chart?

The chart above shows bullish candlesticks in green and bearish candlesticks in red. This very simple strategy has proven to be powerful in reversal tests and real trades using Hikkin-Ashi. This strategy consists of Hickin-Ashy reversal patterns and the popular momentum indicator. I also like the Simple Stochastic Oscillator with settings (3,7,14). If two bullish or bearish candlesticks in the daily chart have a completely full body, as in the picture, the return pattern is valid.

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

Sales settings

When the price falls in two consecutive red candlesticks after a series of green candlesticks, the trend goes out of uptrend and the probability of a return is high. The selling position should be checked.

Purchase settings

If the price falls into two consecutive green candles after a series of red candlesticks, the trend will exit the downtrend and the probability of a return is high. The buying position should be checked.

Filters

The formation of raw candles (empty body) is not enough to have a valuable trading strategy. The trader needs other filters to eliminate false signals and improve performance.

Momentum filter (stochastic oscillator with settings (3,7,14))

I recommend using a simple oscillator with settings (3,7,14).

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

Now trader:

After two consecutive red candlesticks , it enters the sell trade completely and the stochastic is above 70.

After two consecutive green candles , it enters the buy transaction completely and the stochastic is below 30.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Stop order filter

To improve daily performance of this strategy, it is better to use other filters. I recommend that you stop ordering in your work settings.

The chart below shows the purchase settings. The trader should place the stop of the buy order slightly higher (for example, a few pips) than the starting price (Open) of the second Hikkin-Ashi return candlestick.

The same method is used for sales settings, and the trader must place the sell stop order slightly lower (a few pips) than the second return candle.

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

Filter oscillator Aksylrtvr ( Accelerator Oscillator ) or ( AC )

Insert >>> indicator >>> Bill Williams >>> Accellarator Oscillator

Another tool you can use is the standard AC Oscillator. This filter is a good indicator for daily charts. Sometimes they are redrawn but often they tend to be drawn once. The load or bar is stored at midnight. How is it used? After the Hykin-Ash candlesticks are drawn, the return is confirmed by the Accelerator Oscillator (AC).

For buying trades : If two consecutive green candles are drawn, we wait for the green AC bars above the zero line to form on the daily chart.

For sales : If two consecutive red candlesticks are drawn, we wait for the AC red bars above the zero line to form on the daily chart .

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

the rules:

Bounce patterns are valid when two bullish or bearish candlesticks are fully formed on the daily chart, for example in the GBPJPY currency pair. Do not trade in a market where we are changing prices in one direction. Be sure to check out the fundamental news in the market. I recommend avoiding days like the following:

- Bank Holidays

- NFP stands for Non-Farm Payroll

- FOMC stands for Federal Open Market Committee

- Central Bank lectures

Financial Management:

- Change your position even after 50 pips of profit

- If the opposite signal is issued, change the stop limit or (stop loss) and you will win the game.

- Set the stop limit of (Stop Loss) 100 pp lower, or use the Local Technical Levels for Stop Loss settings.

- Every trader is advised to follow his financial management rules.

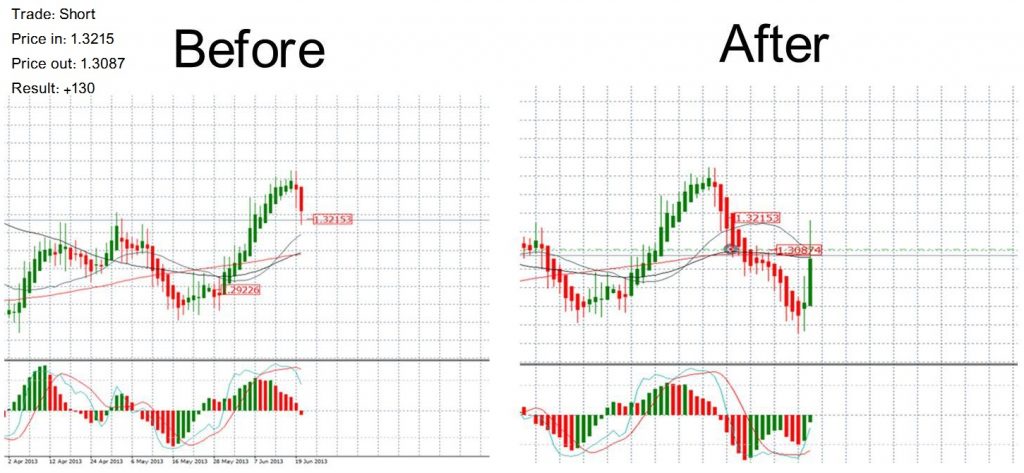

Examples of strategies and images

Strategy does not produce a lot of adjustments, but when adjustments are made, they are usually the most important ups and downs of the market. See some transaction examples before and after the settings.

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

Heiken Ashi MetaTrader 4 Forex Automated Trading and Strategy Maker

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Reviews

There are no reviews yet.