Description

ATR Indicator Training Medium Amplitude Oscillator

In this article, we are going to explain the ATR indicator or the real range average. The ATR Indicator is an indicator first introduced in 1978 by Welles Wilder in New Concepts in Technical Trading Systems, an indicator that, in fact, the moving average has a variable called the correct amplitude in a 14-candlestick period (by default). Measures the amount of price fluctuation in the price charts of financial markets and stock exchanges; One of the important properties of this indicator, which is in the category of oscillators, is that it shows the fluctuations in the stock market well.

What is an Oscillator?

An oscillator is an analytical tool subset of indicators that contains one or more graphs containing computational data formulas. It is formed in a range with a definite upper and lower limit, which is used through two open intersections of the middle level or oscillation between border dams. Oscillators are preferred by short-term oscillators in neutral (Range-Side) price charts. Using the ATR or Average True Range indicator in long-term trading will have better results.

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

What is an ATR indicator ?

You may have encountered the problem in the stock market when you identify a trend in the chart, how to predict the price target of that trend, and even find the limit or rejection of your signal. The ATR indicator will help us to clarify this given the moderate trend of the past; Approximately to what extent one can expect the share price to go in the direction of its trend. Accordingly, the ETR indicator will evaluate the average share price movement in specific periods and inform us.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

The ATR oscillator, like many other indicators, uses 14 cycles or candlesticks by default. We use this indicator in addition to the indicators like the RSI and the indicator Ichimoku and stochastic indicator and the MACD can be used.

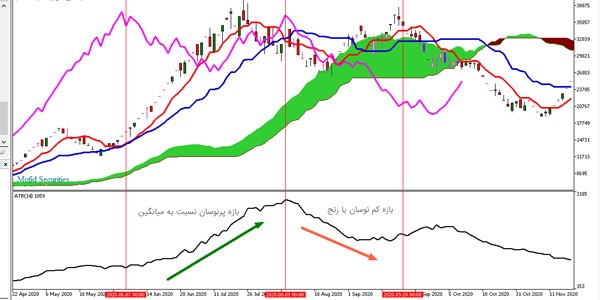

If the ATR value stays low for a long period of time, it indicates a stabilization of the price in the stock market. This is because the lower the ATR value, the lower the price fluctuation in the market and the higher the higher the price fluctuation in the market.

ATR oscillators are non-momentum indicators of the stock market that do not show the direction of the market and whenever the price fluctuates in the market increases, the range of ATR movement increases and whenever the fluctuations decrease, the ATR decreases.

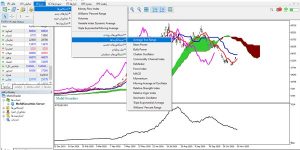

How to open the ATR indicator in MetaTrader and Tradingview

To open the ATR indicator in the Trader utility software environment, after opening the TAB insert (INSERT), enter the INDICATORS drop-down menu, then select the oscillators drawer, and finally select the average true range indicator.

In Rahavard 365 stock exchange site, which uses the tradingview engine for the stock market of Iran, you can use the options of indicator or shortcut key (/) and search for the name of ATR indicator and execute it.

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

ATR indicator calculation formula

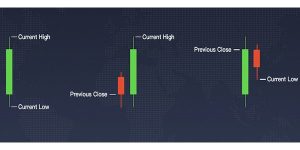

To calculate the indicator, you must first calculate the value (TR), which is calculated from the following formula.

TR=Max[(H – L),Abs(H – CP),Abs(L – CP)]

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

In this formula, the largest (MAX) number obtained between the three considered items determines the amount of TR, which are as follows:

Highest candlestick current price (H) minus lowest candlestick current price (L)

Absolute value between the highest current candlestick price (H) minus the previous day candlestick closing price (Cp)

Absolute value (Abs) Lowest candlestick price now (L) minus candlestick closing price the day before (Cp)

The absolute value is the unit of displacement from the number zero, regardless of whether the number is positive or negative, which is indicated by the symbol (I). For example:

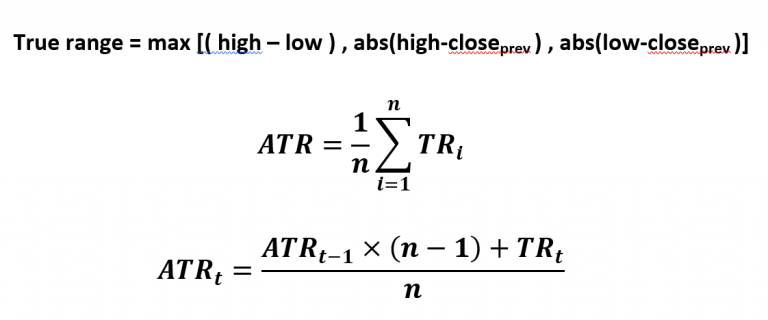

The next step is to calculate atr.

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

i = the average correct range of our previous candlestick

t = current candlestick

t-1 = a previous candlestick

n = ATR period length

Application of ATR indicator in market price charts

In charts where price gaps and limited flows often occur, the price of a stock opens higher or lower than the maximum allowable interval of the day, and measuring fluctuations based solely on candlestick horns and tails, many indicators can not detect these fluctuations when creating Recognize price chat. Therefore, the ATR indicator was designed to identify this type of fluctuations in a timely manner, and it should be noted that this indicator does not show the price direction at all and only indicates its fluctuations.

Direct uses of the ATR indicator

1- The range of movement of the daily price chart of the stock market can be carefully examined.

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

2- Getting buy and sell signals in trades, which, of course, the ATR indicator alone is not a good signal to enter or exit the trade and must be used in combination with other strategies.

3. Get help from ATR values to calculate the loss or signal rejection (SL) limit or signal success or gain (TP).

4- Distinguishing the market with high power and high volatility from the suffering market, but in no way shows us the direction of the market; Because it is one of the non-momentum indicators.

How to use ATR in capital markets trading

When you receive a buy signal in a trade according to your trading strategy, you can use the ATR indicator to check the extent of overcoming the average fluctuations in the range specified in the indicator, which is 14 candlesticks by default. Thus, if the ATR indicator is bullish, the strength of the trend and sharp price fluctuations in that range can be realized. Also, if it is a downtrend, it indicates a market without fluctuations and suffering, which can bring you a dream of capital for a while.

Failure of a support or resistance level or level if it is accompanied by an increase in the amount of ATR indicates a sell pressure or a strong buy pressure.

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

How to calculate the profit and loss limit in stock trading by ATR

Regarding the calculation of the profit margin to the loss limit, it is possible to use the current ATR number in the indicator, which shows the chart of stock price fluctuations in the Iranian stock market, and in the Forex market, which is based on the pip, according to the strategy and risk management. Rivard, which can be a value equal to 1 to 1.8 or 1 to 2 or 1 to 3 in this way.

Now ATR * X = Y

X = 1/8 or X = 2 or X = 3

Signal Success Rate (TP = Y) Current price to trade + Signal Rejection Price (SL) = current price to trade – atr now

ATR MetaTrader 4 Forex Automated Trading Strategy Maker

Conclusion

As mentioned, the ATR indicator is an example of an excellent price chart analysis tool for price fluctuations, which is actually a variable that is always very important in price charts or investing in financial markets. This indicator is the best option to measure the overall strength of a single and reach the trading range.

Most traders use ATR to protect their profits in the market. It is better to use the ATR indicator in the long run; But it can also be used in short-term intervals such as daily. If your strategy is based on volume, it can be a good tool for you in the direction of the signal to ensure the entry of stock trading, as well as determining the limit of losses and profit limits in stock trading.

We hope this article is of maximum use to you in the stock market. Please share any questions or concerns about the ATR indicator as well as optimize this article for greater productivity.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Reviews

There are no reviews yet.