Description

Traders use a variety of tools to technically analyze their stocks or other assets. Indicators are a group of these tools that signal to us what stock to sell or hold at any given time and which stock to buy. In this article, we will introduce one of the well-known indicators called CCI indicator.

7. Strategies for using the CCI indicator

What is a CCI Indicator?

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

CCI indicator or the “Commodity Channel Index» ( C Ommodity C Hannel I Ndicator) by “Donald Lambert» (Donlad Lambert) about 40 years ago, came into existence. Lambert was a commodity trader who used this indicator to analyze commodity exchanges. This indicator is an oscillator or oscillator. An oscillator is a technical analysis tool that determines the range between the upper and lower boundaries, and then creates a trend indicator that oscillates between the two boundaries.

This index is also based on the “acceleration” or “momentum” (Momentum) of the trend; This means that the strength of the recent price trend is highly noticeable. Impulse indicators show us the acceleration of the trend. Impulse tells us the rate of acceleration of the price or volume of an asset, and is, in fact, the rate of change of price. When a trader buys and sells based on the acceleration of the buying process, he decides on the basis of increasing the speed of price change.

Those who buy and sell due to the impulse do not follow the traditional principle of buying at a low price and selling at a high price. They are looking to sell at a low price and buy at a lower price or to buy at a high price and sell at a higher price. Instead of looking for patterns to continue or reverse the trend, impulsive investors are paying attention to the recent trend caused by price failure.

The CCI indicator is used to inform a person when the price of an asset exceeds its real value, the so-called “over-thought” value, and is traded at a higher price. Similarly, the CCI indicator determines when the value of an asset is below its real value, that is, it is sold at a price lower than its original price, in other words, it is “over sold”.

Traders usually expect the price trend to correct and not remain oversold or overbought. Perhaps when a stock is sold at a price higher than its intrinsic value, the trader decides to sell it. Many investors use the P / E ratio to check if the stock is over-selling or over-buying.

However, determining whether a stock is selling above its real value depends on the mindset of the analyst, as traders and analysts use different tools for analysis. Some may think the stock is selling for more than its real value, but other analysts do not. An overpayment of a share can be due to good news published by that company.

It is also possible to determine whether a stock is selling at a price higher or lower than its real value by the RSI indicator. This index is also used to evaluate the direction and strength of the price trend. In the following, the RSI index is further examined.

The power of the trend refers to the power of the “Bulls” and the “Bears” in a market and in a certain period. In a weak or weak uptrend, the trend may be bullish, but it is still possible to face significant downtrends. In a bullish uptrend, the risk is lower and more profitable trades are made.

Likewise, in a weak trend, there is a possibility of risky trading, and buying and selling in a weak trend may cast doubt on the trader and undermine his confidence.

In general, the market trend may be upward, downward or moving in the middle. By giving this information to shareholders, indicators give them the power to decide whether they want to enter into a trade or not.

Lambert first developed the CCI indicator to detect periodic changes in commodities, but this indicator can also be used for indices and tradable funds or ETFs. Contrary to its title, the CCI indicator can be used in any market and is not limited to the commodity market.

The CCI indicator was first created to measure long-term trend changes, but has been used by investors in a way that can be used for all markets in all time frames. Trading with different time frames creates more buy and sell signals for active traders.

The CCI index compares the current price with the average price over a period of time. This indicator fluctuates above and below zero and may be positive or negative. Although most values (about 75% of them) are in the -100 to +100 range, 25% of the values are outside this range, indicating weakness or strength in the price movement. In fact, the CCI indicator makes a relative comparison between the current price and the previous price movement.

A simple example of analysis with a CCI indicator

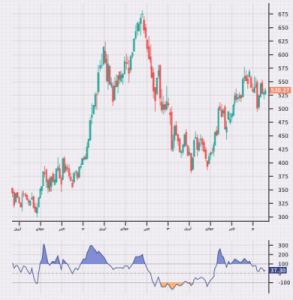

As you can see in the image below, the CCI analysis chart uses more than 30 periods. Because this chart is monthly, each new calculation is based on data from the last 30 months. Of course, technical analysis also uses 20-period and 40-period CCIs. Each period refers to the number of bar or pile charts that are taken into account in calculating the indicator.

Charts can be 1-minute, 5-minute, daily, weekly and monthly, or any other time frame available. The larger the selection period, the less likely it is that the indicator will move outside the range of -100 and +100. Stakeholders who consider the short-term interval for analysis should note that there are more signals in shorter time periods (when we have fewer bar charts).

CCI MetaTrader 4 Forex Automated Trading Strategy Maker

Indicator calculations are performed automatically by charting software or trading platform. You must first have a CCI indicator on your trading platform. Just enter the number of periods you want and select a “Time Frame” for your chart.

When the CCI is above +100, it means that the price is higher than the average price recorded. When the indicator shows a number less than -100, it means that the price is lower than the average price measured by the indicator. Traders who consider the long-term time frame look for a longer period of 30 or 40 periods. Using a daily or weekly chart is recommended for long-term investors. Short-term investors can also use this indicator for a one-hour or even one-minute chart.

How to calculate CCI?

Although different platforms today easily calculate CCI, it is useful to be familiar with the systematic method of calculating CCI to better understand it. To calculate CCI, we must first determine how many courses we want to analyze with this index. Usually 20 cycles are used to calculate CCI. Shorter periods cause the index to be more volatile and more volatile. On the other hand, if the trader considers more periods, the analysis error will be less.

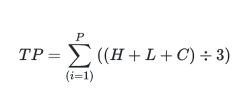

Suppose we want to calculate the product channel index for the last 20 periods. If you plan to use a number of different courses, you will need to change the CCI calculation formula. First calculate the “High Price”, “Low Price” and “Closing Price” for 20 periods and get the sample price. Then, calculate the 20 moving average periods of the sample price by adding the last 20 sample prices and dividing it by 20, and obtain the deviation from the mean by subtracting the moving average from the sample price for the last 20 periods.

Note that you have to add the absolute values together (consider the negatives positive) and then divide the total difference of the means by the number of periods, which here is 20. You must enter the most up-to-date moving average sample price and mean deviation in the formula to get the current CCI. This process must be repeated for each new period.

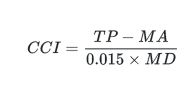

CCI is calculated according to the following formula:

CCI MetaTrader 4 Forex Automated Trading Strategy Maker

where in:

CCI MetaTrader 4 Forex Automated Trading Strategy Maker

CCI MetaTrader 4 Forex Automated Trading Strategy Maker

As we can see, there is a coefficient of 0.015 in the CCI calculation formula. This number is the same as Lambert’s constant. Lambert multiplied the rest of the formula by this number to get most of the CCI values between -100 and +100. As a result, 70 to 80 percent of the values fall between this range. What percentage of CCI values fall in the -100 to +100 range is affected by the number of courses.

If the number of selected courses is small and the duration of each course is limited, a small percentage of the CCI indicator values will be between -100 and +100. Conversely, if the number of courses is higher, a significant percentage of the calculated values will be in the range of -100 to +100.

What does the CCI indicator tell us?

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

The priority is to use CCI to discover emerging trends. As mentioned earlier, the CCI indicator is also used to identify buy and sell levels. Also, when the indicator and the price trend diverge and move in a different direction, CCI is used to discover the challenge points of the trend.

When the CCI indicator goes negative or close to zero above 100, it may indicate that the price is starting a new uptrend. When this happens, traders can see a pullback and then a resurgence in price and indicators, which can be interpreted as a buy signal. The pullback is the reversal of the price trend in the short run.

We can get the same interpretation from an ongoing downtrend. When an indicator falls below -100 from a positive level or close to zero, a downtrend is likely to occur. This is a signal to refrain from holding stocks or commodities, or to be careful when selling stocks so that we do not incur a loss if the potential price drops.

Buying and selling areas are not fixed, which is why the CCI is considered an “unbounded” indicator. As a result, traders refer to their previous observations to examine the possible reversal of the price trend. For example, this reversal may have occurred for a share at the +200 and -150 limits.

For other commodity shares, the price may be reversed at +32 and -350. If we reduce the magnification, in the overall picture of the chart we will be able to see a large number of price reversals and CCI readings at those times.

You may also experience divergence when working with the CCI indicator. This happens when the price and the indicator move in two different directions. If the price is rising and the CCI is falling, it indicates a weakness in the trend line. Although the dichotomy between the CCI and the price is a weak trading signal, it can warn the trader that a reversal of the price is possible, as this situation may persist for a long time.

However, seeing a divergence between the CCI and the price does not necessarily indicate a price reversal.

In this way, investors can reduce their loss range. For example, if a trader has set his 10% loss range, he will sell when the stock price falls below 10% of a person’s purchase price.

CCI is also used in stock and currency analysis. In the CCI indicator, the big positive data gives the signal that the asset is trading stronger than before compared to the forecast based on past trends. Also, small negative values indicate that trading in these stocks is weak.

Difference between CCI indicator and stochastic oscillator

The Stochastic Oscillator is a momentum indicator that compares the closing price of a stock to a range of the same stock price over a period of time. The Stochastic Oscillator Indicator, like the CCI, identifies the best-selling and best-selling points and is older than the CCI. The stochastic oscillator fluctuates between 0 and 100. At points in the chart where this indicator reaches above 80, we will have a buy signal and we will have a sellout of less than 20. Of course, these do not always indicate a reversal in the near future.

Strong trends can stay longer in the case of over-selling or over-buying. Therefore, traders should consider changes in the stochastic oscillator to be aware of future trend changes. Both of these indicators are oscillators, but are calculated in different ways. One of the main differences is that the stochastic oscillator is limited to zero and 100, while, as mentioned, the CCI has no boundaries. Due to the differences in how these two indicators are calculated, they give different signals at different times.

Difference between CCI indicator and RSI indicator

“Relative Strength Index» ( R Elative S Trength I Ndex) or RSI is an oscillator like CCI known technical analysis is used to determine how far prices. The difference is that the CCI focuses on deviating from the moving average price of an asset to detect divergence from the trend line.

The RSI compares the relationship between the average high closing price and the average low closing price over a period of time (typically 14 days). The values calculated by the RSI are then placed on the moving line below the price chart. All values fluctuate between zero and one hundred and the midpoint is 50. Using the RSI indicator allows the trader to distinguish between possible buys (above 70) and overselling (below 30).

Unlike CCI, RSI is not borderless and is probably easier to get information from. Since both the relative strength indices and the commodity channel are indicators of trend acceleration, they can give an upward or downward divergence signal. This happens when the new price reaches a peak and the valleys are not reflected by the indicator peaks and valleys. These dichotomies indicate a possible reversal of trends. In general, in most markets, RSI is a more reliable tool than CCI, and many traders prefer its relative simplicity.

If you are unsure which of these indicators to use to determine the levels of overselling or overselling, you can consider both indicators at the same time depending on your trading model. These oscillators display the same data.

It should be noted that the RSI takes into account the speed of price changes, while the primary goal of the CCI is to track periodic deviations. You can use both of these metrics for different trading strategies. It is also possible to combine the two and create a trading strategy that will yield amazing results.

Strategies for using the CCI indicator

Strategies and indicators are not risk-free, and one may achieve better performance in stock trading by adjusting trading strategies and the indicator period or time frame. Although all systems are prone to loss, having a loss limit can help us set a limit to our risk.

Testing the CCI strategy for market profitability and time frame is also a valuable first step before you start buying and selling. In the following, we introduce two strategies that can be used for technical analysis using the CCI indicator.

Basic CCI Indicator Strategy

A simple strategy is to follow the CCI path for 100+ moves that represent the buy signal. We can also look at movements below -100 that sell signals. Investors may just want to pay attention to the buy signals and go out when the sell signals occur and re-invest when the buy signal is issued.

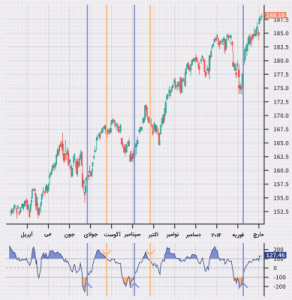

The chart below shows the changes in the price of a share from 2011 to 2014. As you can see in the weekly chart below, a sell signal is issued when the CCI shows values below -100. The chart below shows the sales signal in orange.

This could tell long-term investors that there was a possible downtrend in the formation path. Investors could use this observation as a signal of a sell-off. The chart shows how a buy signal was issued in early 2012 and traders bought the stock in the hope that its price would rise to bring the CCI below -100.

CCI MetaTrader 4 Forex Automated Trading Strategy Maker

CCI indicator strategy with several time frames

The CCI indicator can be used in several time frames. In this analysis, short-term and long-term diagrams are used simultaneously. More active traders often use a strategy with multiple time frames. When the CCI reaches above +100 in the long term chart, it indicates an uptrend and in the short term chart we should expect to receive a buy signal. The trend is considered bullish until the long-term CCI goes to -100.

CCI MetaTrader 4 Forex Automated Trading Strategy Maker

The chart above shows a weekly uptrend since the beginning of 2012. If this is our long-term chart, we will only receive a buy signal on the short-term chart. When traders analyze using the daily chart (as a shorter time frame), when the CCI falls below -100 and then returns higher, it is considered a buy signal.

On the other hand, when the CCI reaches a value above +100 and returns to it, it can be a sign of a time out of the stock. In addition, if the trend on the long-term CCI declines, it is a sell signal that tells you to no longer hold stocks in the hope of raising their price.

The chart above shows the three buy signals in purple and the two sell signals in orange in the daily chart. Borrowing sales have not started because the CCI is on the upside in the long run.

When the CCI on the long-term chart is below -100, consider only the sell-off signals on the short-term chart. We will have a downtrend until the long-term CCI increases and exceeds +100. This chart indicates that the trader should borrow to sell until the CCI indicator in the short term chart reaches above +100 and then returns below +100.

When the CCI indicator in the short term chart falls below -100 and then rises to above -100, traders are out of stock. Periodically, if the long-term CCI trend increases, the individual should eliminate borrowing sales.

Changes in CCI strategies

We can use the CCI to set the rules of strategy, that is, to change the trading strategy we have in mind. For example, when we use multiple time frames, we can tighten the strategy, that is, when the long-term CCI is above +100, in the short-term, we pay attention to signals that tell us to hold the stock, because its price will rise. Found. This strategy reduces the number of signals, but gives us confidence that the overall trend is strong.

Entry and exit rules can also be adjusted in the short term. For example, if the price trend is bullish over the long term, one may allow the CCI short-term chart to go below -100 before selling and then return to above zero (instead of -100). In this case, the person pays a higher price, but is more confident that the short-term pullback is over and the long-term trend is starting again.

In the case of leaving the stock, you can wait for the price to go above +100 and then fall below zero (instead of +100), then leave the stock. This means that tolerating a few light pullbacks can increase profits during a strong trend.

Shortcomings of the CCI indicator

Despite the applications and positive points that we have said about the CCI indicator, this index also has shortcomings, among which the following can be mentioned:

- Although this indicator is used to determine the best-selling and best-selling positions, it is possible that this diagnosis is highly dependent on the analysis and perception of the trader himself.

- This indicator is delayed, which means that sometimes it is possible to provide a weak signal. A price increase may be imminent, but we get the signal late, and when we try to take action, the price is correcting and we lose our position to trade.

As a result, it is best to use price analysis and other technical analysis tools and indicators alongside the CCI indicator to see if we should take the signals from the CCI indicator seriously.

Concluding remarks

The CCI indicator is one of the most well-known indicators among traders who use technical analysis. Commodity channel index is an indicator with several uses. With the help of CCI, it is possible to identify the levels of overselling and overselling and to identify divergences. It should be noted that there are many aspects to price that may not be identified by the CCI.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

Reviews

There are no reviews yet.